Your Effect of deflation on real estate images are available in this site. Effect of deflation on real estate are a topic that is being searched for and liked by netizens today. You can Download the Effect of deflation on real estate files here. Download all royalty-free photos.

If you’re searching for effect of deflation on real estate images information connected with to the effect of deflation on real estate topic, you have pay a visit to the ideal blog. Our site always provides you with hints for seeing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

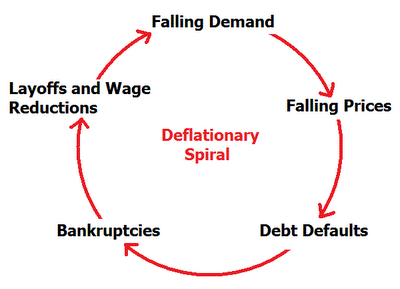

Effect Of Deflation On Real Estate. Impact of deflation on retirees. Though the trend has shown the opposite scenario and real estate has shown inflation after the recession Hartman explains that if we have a lot of deflation that affects real estate prices and values go down rent may or may not go down as well. An increase in the money supply. To many economists deflation is more serious than inflation because deflation is more difficult to control.

At first it seems that dropping prices would be a good. How does deflation affect real estate. If continuing deflati0n is expected there could be fewer people taking mortgages. In other words deflation is the destruction or elimination of the build up in debt associated with inflation. Even if deflation does exist in the consumer market it is not clear how it will affect the various real estate. 3- Rental rates will soar.

To many economists deflation is more serious than inflation because deflation is more difficult to control.

To many economists deflation is more serious than inflation because deflation is more difficult to control. The determining factors are what Hartman calls the 3 Dimensions of Real Estate. This creates a liquidity. To many economists deflation is more serious than inflation because deflation is more difficult to control. Though the trend has shown the opposite scenario and real estate has shown inflation after the recession Hartman explains that if we have a lot of deflation that affects real estate prices and values go down rent may or may not go down as well. Cooling measures could be lifted or rolled back.

Source: icis.com

Source: icis.com

In February 2020 36 of loans were delinquent while in 2019 the rate was 40. Deflation means that your money is more valuable. Deflation is associated with an increase in interest rates which will cause an increase in the real value of debt. Inflation and deflation are both are complex to fully understand. How does deflation affect the use of leverage in real estate investments.

Source: pinterest.com

Source: pinterest.com

Especially in todays world where there is money being printed to support the various government interventions. Since February 2019 delinquencies on loans decreased 04. Inflation and deflation are both are complex to fully understand. How does deflation affect the use of leverage in real estate investments. Deflation means that your money is more valuable.

Source: pinterest.com

Source: pinterest.com

However what really counts is the real not nominal interest rate and lower inflation actually helps improve the after tax return. At first it seems that dropping prices would be a good. However what really counts is the real not nominal interest rate and lower inflation actually helps improve the after tax return. Deflation is an economic theory which deals with the general reduction in the price levels or in the prices of a type of good or asset. To many economists deflation is more serious than inflation because deflation is more difficult to control.

Source: savvyrealestateinvestor.com

Source: savvyrealestateinvestor.com

This could result in loan-to-value breaches banks foreclosing on loans and distressed sales of commercial property reducing the amount of leverage in the system. Deflation means that your money is more valuable. Impact of deflation on retirees. Delinquencies on Mortgages Could Increase. Though inflation is much more common than its opposite known as deflation or sinking prices there have been a few short instances of the latter in recent memory.

Source: pinterest.com

Source: pinterest.com

Though the trend has shown the opposite scenario and real estate has shown inflation after the recession Hartman explains that if we have a lot of deflation that affects real estate prices and values go down rent may or may not go down as well. Though the trend has shown the opposite scenario and real estate has shown inflation after the recession Hartman explains that if we have a lot of deflation that affects real estate prices and values go down rent may or may not go down as well. Changed spending habits fuel deflation. They anticipate paying bac. This creates a liquidity.

Source: pinterest.com

Source: pinterest.com

Before COVID-19 hit and the recession began mortgage delinquency rates were the lowest theyve been in 21 years. Delinquencies on Mortgages Could Increase. Before COVID-19 hit and the recession began mortgage delinquency rates were the lowest theyve been in 21 years. Back in the States where our stimulus is not getting outside the banks to allow for new loans that fuel demand it is unlikely that the velocity of domestic funds will increase anytime soon. In February 2020 36 of loans were delinquent while in 2019 the rate was 40.

Source: es.pinterest.com

Source: es.pinterest.com

Delinquencies on Mortgages Could Increase. However what really counts is the real not nominal interest rate and lower inflation actually helps improve the after tax return. The increase in rental rates is one of the most noticeable effects of inflation. This creates a liquidity. With respect to individual real estate projects its worth examining whether a sponsor has a plan to mitigate the effect of inflation on NOI particularly in the case of a long hold with substantial rental cash flow.

Source: pinterest.com

Source: pinterest.com

Due to the high cost that comes with mortgages most people will opt to rent rather than buy. Deflation on the other hand is a reduction in available money and credit that results in a decrease in the price level. In other words deflation is the destruction or elimination of the build up in debt associated with inflation. To many economists deflation is more serious than inflation because deflation is more difficult to control. Impact of deflation on retirees.

Source: quora.com

Source: quora.com

In February 2020 36 of loans were delinquent while in 2019 the rate was 40. Deflation is associated with an increase in interest rates which will cause an increase in the real value of debt. With respect to the effects of Deflation one should not mix up the concept with that of a temporary decrease in the prices. Due to the high cost that comes with mortgages most people will opt to rent rather than buy. However what really counts is the real not nominal interest rate and lower inflation actually helps improve the after tax return.

Source: pinterest.com

Source: pinterest.com

The effects of Deflation are immense on the economic conditions of a particular nation. Since February 2019 delinquencies on loans decreased 04. Impact of deflation on retirees. To be honest whether deflation occurs in our real estate market is moot. Policymakers may reverse their actions and reopen the credit spigots again.

Source: pinterest.com

Source: pinterest.com

As the historical data suggests you may want to give preference to investments that do not rely too heavily on interim rental cash flow to deliver strong returns as values and hence exit sale. At first it seems that dropping prices would be a good. In other words deflation is the destruction or elimination of the build up in debt associated with inflation. This could result in loan-to-value breaches banks foreclosing on loans and distressed sales of commercial property reducing the amount of leverage in the system. With respect to the effects of Deflation one should not mix up the concept with that of a temporary decrease in the prices.

Source: pinterest.com

Source: pinterest.com

Changed spending habits fuel deflation. In other words deflation is the destruction or elimination of the build up in debt associated with inflation. The increase in rental rates is one of the most noticeable effects of inflation. Changed spending habits fuel deflation. The focus here has been rising prices which we call Price inflation which is commonly the result of Monetary Inflation ie.

Source: pinterest.com

Source: pinterest.com

Furthermore since debt secured against real estate is fixed in money terms under deflation its value increases in real terms. Since deflation is defined as a general decrease in the price level of goods and services when you buy a house in a deflationary environment there may be a chance that there will be negative equity in your home. However what really counts is the real not nominal interest rate and lower inflation actually helps improve the after tax return. At first it seems that dropping prices would be a good. Especially in todays world where there is money being printed to support the various government interventions.

Delinquencies on Mortgages Could Increase. Since deflation is defined as a general decrease in the price level of goods and services when you buy a house in a deflationary environment there may be a chance that there will be negative equity in your home. Lets take a look at the different effects of. Cooling measures could be lifted or rolled back. At first it seems that dropping prices would be a good.

Source: snbchf.com

Source: snbchf.com

This creates a liquidity. Back in the States where our stimulus is not getting outside the banks to allow for new loans that fuel demand it is unlikely that the velocity of domestic funds will increase anytime soon. Deflation is associated with an increase in interest rates which will cause an increase in the real value of debt. Though the trend has shown the opposite scenario and real estate has shown inflation after the recession Hartman explains that if we have a lot of deflation that affects real estate prices and values go down rent may or may not go down as well. Deflation on the other hand is a reduction in available money and credit that results in a decrease in the price level.

Source: pinterest.com

Source: pinterest.com

To many economists deflation is more serious than inflation because deflation is more difficult to control. Lets take a look at the different effects of. Inflation and deflation are both are complex to fully understand. It buys more with less. Deflation means that your money is more valuable.

Source: pinterest.com

Source: pinterest.com

Cooling measures could be lifted or rolled back. The increase in rental rates is one of the most noticeable effects of inflation. In February 2020 36 of loans were delinquent while in 2019 the rate was 40. With respect to the effects of Deflation one should not mix up the concept with that of a temporary decrease in the prices. When asset prices are falling households and investors hoard cash because cash will be worth more tomorrow than it is today.

Source: in.pinterest.com

Source: in.pinterest.com

How does deflation affect real estate. Deflation is an economic theory which deals with the general reduction in the price levels or in the prices of a type of good or asset. Deflation means that your money is more valuable. Though inflation is much more common than its opposite known as deflation or sinking prices there have been a few short instances of the latter in recent memory. As with all other things real estate prices would decrease.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title effect of deflation on real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.