Your Florida capital gains tax on real estate images are ready. Florida capital gains tax on real estate are a topic that is being searched for and liked by netizens now. You can Find and Download the Florida capital gains tax on real estate files here. Download all royalty-free photos and vectors.

If you’re searching for florida capital gains tax on real estate pictures information related to the florida capital gains tax on real estate keyword, you have pay a visit to the right blog. Our website always gives you hints for seeking the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

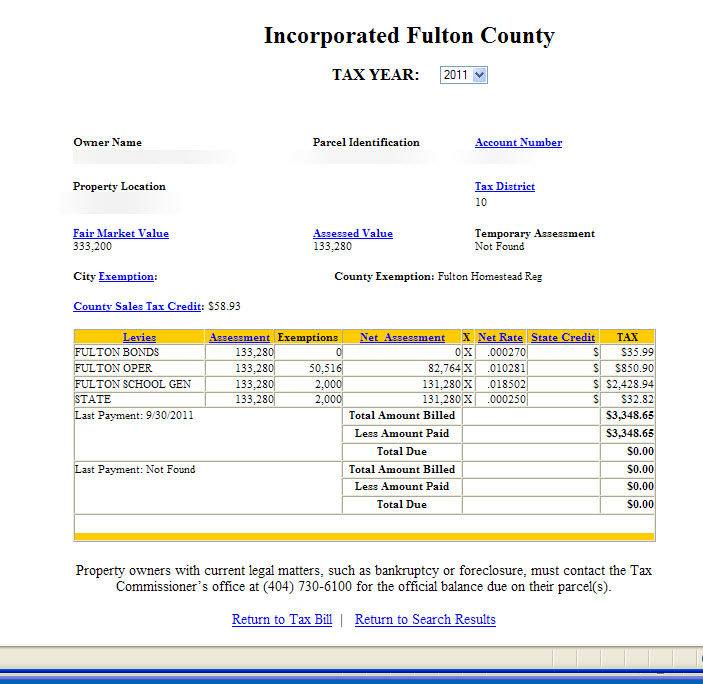

Florida Capital Gains Tax On Real Estate. When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation. All properties in Florida are assessed a taxable value and owners are responsible to pay annual property taxes based on that value. For those earning above 496600 the rate tops. Calculating Capital Gains On Your Florida Home Sale.

برجام با خانه دار شدن مردم چه می کند خروج آمریکا از برجام در اخبار بازار متر Real Estate Investing Property Investor Real Estate Investment Companies From pinterest.com

برجام با خانه دار شدن مردم چه می کند خروج آمریکا از برجام در اخبار بازار متر Real Estate Investing Property Investor Real Estate Investment Companies From pinterest.com

In real estate capital gains are based not on what you paid for the home but on its adjusted cost basis. As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida. When selling your primary home you can make up to 250000 in profit or double that if you are married and you wont owe anything for capital gains. Apart from federal income tax the capital gains calculator also computes the state tax on capital gains. Single homeowners pay no capital gains taxes on the first 250000 in profits from the sale of their home. The first is the property tax.

That tax is paid to the local Florida municipality.

3050 Biscayne Boulevard Suite 604 Miami FL 33137 Phone. 500000 of capital gains on real estate if youre married and filing jointly. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital. Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20. This is a tax paid on the profits that you make on the sale of your Florida house. Consult with your accountant to see how a real estate sale will impact you.

Source: in.pinterest.com

Source: in.pinterest.com

52 Zeilen The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. Any amount exceeding these numbers is taxed at 20 percent which is down from the previous tax amount of 28 percent. How long the property was in your name your income and your tax filing status. If the asset is owned for greater than one year capital gains tax rates are applied to the amount of gain zero for gains that would otherwise be taxed at the 10 or 15 rates 15 for gains that would be taxed at the 25 28 33 or 35 and 20 for gains that would be taxed at the 396 rate. Apart from federal income tax the capital gains calculator also computes the state tax on capital gains.

Source: pinterest.com

Source: pinterest.com

If you sell the property now for net proceeds of 350000 youll. In real estate capital gains are based not on what you paid for the home but on its adjusted cost basis. 52 Zeilen The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. If the asset is owned for greater than one year capital gains tax rates are applied to the amount of gain zero for gains that would otherwise be taxed at the 10 or 15 rates 15 for gains that would be taxed at the 25 28 33 or 35 and 20 for gains that would be taxed at the 396 rate. 3050 Biscayne Boulevard Suite 604 Miami FL 33137 Phone.

Source: pinterest.com

Source: pinterest.com

When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation. Capital gains taxes are taxes you pay on profit from selling your real estate investment property. For those earning above 496600 the rate tops. Your primary residence can help you to reduce the capital gains tax that you will be subject to. You can maximize this advantage by frequently moving homes.

Source: pinterest.com

Source: pinterest.com

Single homeowners pay no capital gains taxes on the first 250000 in profits from the sale of their home. How do I calculate capital gains tax on real estate sold. This is the sale price minus any commissions or fees paid. The amount of capital gains taxes you pay varies depending on the profit made and your specific situation. If you sell the property now for net proceeds of 350000 youll.

Source: pinterest.com

Source: pinterest.com

All properties in Florida are assessed a taxable value and owners are responsible to pay annual property taxes based on that value. The capital gains tax is calculated on the profit made from the real estate sale minus expenses and the applicable capital gains tax will depend on who holds the title. Over the 10-year ownership period youve claimed a total of 90900 in depreciation expense. Subtract that from the sale price and you get the capital gains. How long the property was in your name your income and your tax filing status.

Source: pinterest.com

Source: pinterest.com

Based on your income bracket and filing status the capital gains tax rate on real estate is either 0 15 or 20. For example if you bought a home 10 years ago for 200000 and sold it today for 800000 youd make 600000. Capital gains taxes are taxes you pay on profit from selling your real estate investment property. This is a tax paid on the profits that you make on the sale of your Florida house. Obtaining the amount requires you to make adjustments including acquisition and improvements costs.

Source: pinterest.com

Source: pinterest.com

When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation. Subtract your basis what you paid from the realized amount how much you sold it for to determine the difference. Obtaining the amount requires you to make adjustments including acquisition and improvements costs. For those earning above 496600 the rate tops. When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation.

Source: in.pinterest.com

Source: in.pinterest.com

Capital gains taxes are taxes you pay on profit from selling your real estate investment property. For those earning above 496600 the rate tops. How long the property was in your name your income and your tax filing status. How do you calculate gain on sale of house. That tax is paid to the local Florida municipality.

Source: pinterest.com

Source: pinterest.com

Any amount exceeding these numbers is taxed at 20 percent which is down from the previous tax amount of 28 percent. Determine your realized amount. That tax is paid to the local Florida municipality. If you sold your assets for more than you paid you have a capital gain. If you were to sell a property the capital gains tax you would owe depends on three main factors.

Source: pinterest.com

Source: pinterest.com

You dont have to live in the property for the last two years either. When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation. The calculator based on your input calculates both short term capital gains as well as long term capital gains tax. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit. The second tax to be aware of is the capital gains tax.

Source: pinterest.com

Source: pinterest.com

For successful investors selling a property can result in significant capital gains tax if. Single homeowners pay no capital gains taxes on the first 250000 in profits from the sale of their home. The first is the property tax. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit. This amount increases to 500000 if youre married.

Source: pinterest.com

Source: pinterest.com

This is the sale price minus any commissions or fees paid. How do I calculate capital gains tax on real estate sold. If you are exchanging properties your accountant can also. Determine your realized amount. Capital gains taxes are taxes you pay on profit from selling your real estate investment property.

Source: pinterest.com

Source: pinterest.com

For successful investors selling a property can result in significant capital gains tax if. This tax is called Capital Gains tax. Any amount exceeding these numbers is taxed at 20 percent which is down from the previous tax amount of 28 percent. If you were to sell a property the capital gains tax you would owe depends on three main factors. This amount increases to 500000 if youre married.

Source: pinterest.com

Source: pinterest.com

Consult with your accountant to see how a real estate sale will impact you. 52 Zeilen The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. In real estate capital gains are based not on what you paid for the home but on its adjusted cost basis. You can maximize this advantage by frequently moving homes. Understanding Capital Gains Tax on a Real Estate Investment Property Real estate properties generate income for investors but taxes play a factor in returns.

Source: in.pinterest.com

Source: in.pinterest.com

As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida. How long the property was in your name your income and your tax filing status. This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale. This is the sale price minus any commissions or fees paid. For those earning above 496600 the rate tops.

Source: pinterest.com

Source: pinterest.com

Capital gains taxes are taxes you pay on profit from selling your real estate investment property. For those earning above 496600 the rate tops. Single homeowners pay no capital gains taxes on the first 250000 in profits from the sale of their home. This is a tax paid on the profits that you make on the sale of your Florida house. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset.

Source: in.pinterest.com

Source: in.pinterest.com

Obtaining the amount requires you to make adjustments including acquisition and improvements costs. You can maximize this advantage by frequently moving homes. The majority of Americans fall into the lowest couple of income brackets which are assessed 0 in capital. 500000 of capital gains on real estate if youre married and filing jointly. The first is the property tax.

Source: pinterest.com

Source: pinterest.com

This amount increases to 500000 if youre married. This is the sale price minus any commissions or fees paid. Any two of the last five years qualifies you for the homeowner exclusion. Over the 10-year ownership period youve claimed a total of 90900 in depreciation expense. In real estate capital gains are based not on what you paid for the home but on its adjusted cost basis.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title florida capital gains tax on real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.