Your Geauga county real estate tax due dates images are available in this site. Geauga county real estate tax due dates are a topic that is being searched for and liked by netizens now. You can Get the Geauga county real estate tax due dates files here. Get all free images.

If you’re searching for geauga county real estate tax due dates images information related to the geauga county real estate tax due dates keyword, you have visit the ideal site. Our website always gives you hints for seeking the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

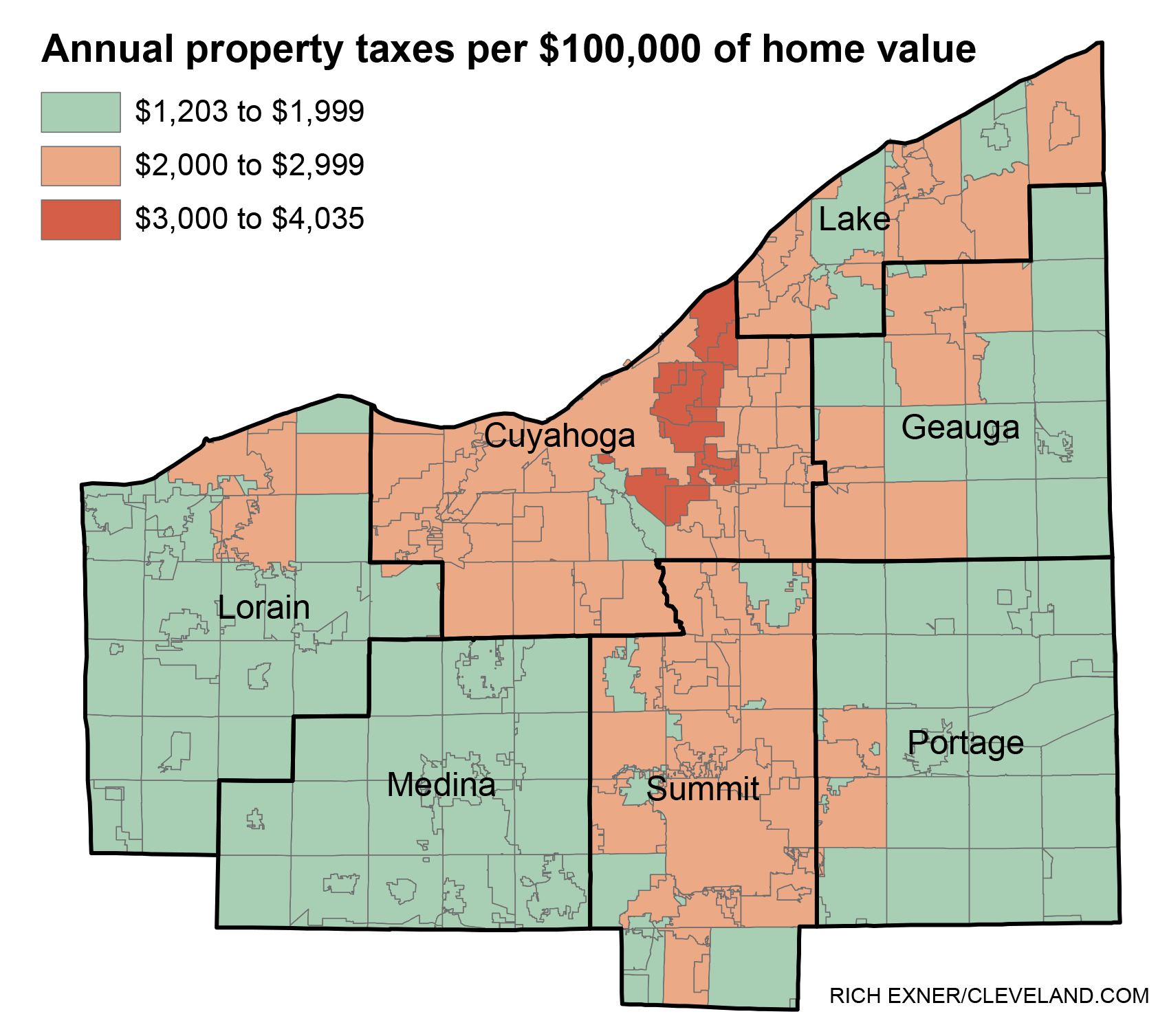

Geauga County Real Estate Tax Due Dates. Paying your property tax. Checking the Geauga County property tax due date. One half of the penalty will be waived if. Tax Year 2019 Levy Changes 2020 Collection Year The following illustrates levy changes in Geauga Countys 33 Taxing Districts Change per 100000 is only reflective of millage changes due to levies listed below Non-Qualifying Levy 10 and Owner Occupancy Credits do not apply Please note that this is a general indication of levy changes.

Geauga County Oh Recently Sold Homes Realtor Com From realtor.com

Geauga County Oh Recently Sold Homes Realtor Com From realtor.com

Geauga County Public Library Board of Trustees - Vacant Position The Geauga County Commissioners Issue A Resolution of Recognition and Appreciation to All of Geauga Countys First Responders. 142 of home value. Of the eighty-eight counties in Ohio Geauga County is ranked 2nd by median property taxes and 10th by median tax. In accordance with state law property taxes are billed at the end of the year in which they are assessed. Property Tax Due Dates. Geauga County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

2nd Half 2016 Real Estate tax bills are sent to taxpayers and mortgage companies.

Geauga County - OH - Tax makes every effort to produce and publish the most accurate information possible. The median property tax in Geauga County Ohio is 3278 per year for a home worth the median value of 230900. A general reappraisal of all Real Property is mandated by Ohio Law every six 6 years with an update during the third year after the appraisal. Please call our office at 330-297-3586 with questions and for additional information. However this material may be slightly dated which would have an impact on its accuracy. Please note that your tax bill may differ from the results given by this application because you may also be charged local special assessment fees.

Source: auditor.co.geauga.oh.us

Source: auditor.co.geauga.oh.us

Real Estate Taxes - Treasurers Office. Click here to view and pay your real estate tax bill online via e-check no additional cost or debitcredit card fee added. Geauga County collects on average 142 of a propertys assessed fair market value as property tax. A 10 penalty will be assessed on any unpaid balance. What happens if I do not pay my real property taxes.

Source: geaugamapleleaf.com

Source: geaugamapleleaf.com

2nd Half 2016 Real Estate tax bills are sent to taxpayers and mortgage companies. 2017 Geauga County Tax Calendar County Auditor certifies 2016 tax roll. IncreasesDecreases my differ due to changes in your. 211 Main Street Suite 1-A. -If you cannot pay your Real Estate Taxes in full by the due date on the front of this bill please contact the Treasurers office 2 weeks after the due date for a payment plan.

Source: pinterest.com

Source: pinterest.com

These records can include Geauga County property tax assessments and assessment challenges appraisals and income taxes. For instance the taxes billed in December 2015 payable in 2016 are the tax charges assessed for the first half of 2015 January June and the second half of 2015 July. The purpose of a Triennial update is to provide a buffer for the six year appraisals. Real Estate Taxes - Treasurers Office. The Geauga County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Geauga County Ohio.

Source: realtor.com

Source: realtor.com

Geauga County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Home Real Estate Taxes Real Estate Taxes. The Auditors Office now provides detailed Real Estate information online through Geauga REALink Geauga Countys property information system. The median property tax also known as real estate tax in Geauga County is 327800 per year based on a median home value of 23090000 and a median effective property tax rate of 142 of property value. This new appraised value will be the basis of which your property taxes are calculated so its very important to start checking the mail in early August of 2017 to see if you agree with the countys assessment of your property.

Source: zillow.com

Source: zillow.com

Once you determine your taxes you can choose to view a table of where the taxes you pay are being distributed. No warranties expressed or implied are provided for the data herein its use or its interpretation. The Geauga County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Geauga County Ohio. The first quarter of 2021 we will be especially busy at your service driven by deadlines. Paying your property tax.

Source: zillow.com

Source: zillow.com

2nd Half 2017 Manufactured Home bills are sent to taxpayers. Geauga County has one of the highest median property taxes in the United. Newbury and Burton Residents. Geauga County Public Library Board of Trustees - Vacant Position The Geauga County Commissioners Issue A Resolution of Recognition and Appreciation to All of Geauga Countys First Responders. Yearly median tax in Geauga County.

Source: auditor.co.geauga.oh.us

Source: auditor.co.geauga.oh.us

In Geauga County the Auditors Office sends letters to property owners in August to let them know what the county appraised their house for. Once you determine your taxes you can choose to view a table of where the taxes you pay are being distributed. Geauga County - OH - Tax makes every effort to produce and publish the most accurate information possible. What happens if I do not pay my real property taxes. Property Tax Due Dates Official November 3.

Source: co.pinterest.com

Source: co.pinterest.com

Geauga County collects on average 142 of a propertys assessed fair market value as property tax. However this material may be slightly dated which would have an impact on its accuracy. Newbury and Burton Residents. 2nd Half 2016 Real Estate tax bills are sent to taxpayers and mortgage companies. Geauga County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Source:

Source:

Tax Year 2019 Levy Changes 2020 Collection Year The following illustrates levy changes in Geauga Countys 33 Taxing Districts Change per 100000 is only reflective of millage changes due to levies listed below Non-Qualifying Levy 10 and Owner Occupancy Credits do not apply Please note that this is a general indication of levy changes. You can contact the Geauga County Assessor for. 2nd Half 2016 Real Estate tax bills are sent to taxpayers and mortgage companies. If you believe they have made an error and that. The median property tax also known as real estate tax in Geauga County is 327800 per year based on a median home value of 23090000 and a median effective property tax rate of 142 of property value.

Source: pinterest.com

Source: pinterest.com

One half of the penalty will be waived if. IncreasesDecreases my differ due to changes in your. 2nd Half 2016 Real Estate tax bills are sent to taxpayers and mortgage companies. Click here to view and pay your real estate tax bill online via e-check no additional cost or debitcredit card fee added. You can contact the Geauga County Assessor for.

Source: cleveland.com

Source: cleveland.com

Paying your property tax. Information on your propertys tax assessment. A 10 penalty will be assessed on any unpaid balance. Pay Property Taxes in Geauga County Ohio using this online service. Newbury and Burton Residents.

Source: auditor.co.geauga.oh.us

Source: auditor.co.geauga.oh.us

Can I pay my taxes online. 211 Main Street Suite 1-A. Geauga County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Geauga County Ohio. A 10 penalty will be assessed on any unpaid balance. Geauga County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Source: pinterest.com

Source: pinterest.com

For instance the taxes billed in December 2015 payable in 2016 are the tax charges assessed for the first half of 2015 January June and the second half of 2015 July. The first quarter of 2021 we will be especially busy at your service driven by deadlines. Geauga County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. The median property tax also known as real estate tax in Geauga County is 327800 per year based on a median home value of 23090000 and a median effective property tax rate of 142 of property value. Of the eighty-eight counties in Ohio Geauga County is ranked 2nd by median property taxes and 10th by median tax.

Source: pinterest.com

Source: pinterest.com

Geauga County - OH - Tax makes every effort to produce and publish the most accurate information possible. Click here to view and pay your real estate tax bill online via e-check no additional cost or debitcredit card fee added. A 10 penalty will be assessed on any unpaid balance. Newbury and Burton Residents. The Geauga County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Geauga County Ohio.

Source: auditor.co.geauga.oh.us

Source: auditor.co.geauga.oh.us

One half of the penalty will be waived if. Real Estate Taxes - Treasurers Office. However this material may be slightly dated which would have an impact on its accuracy. The Tax Rates in the list below are certified for the listed year as approved by the Geauga County Budget Commission certified by each taxing district to the County Auditor with the effective tax rates as certified by the Department of Tax Equalization applied in December of their respective years. Newbury and Burton Residents.

Source: realtor.com

Source: realtor.com

Taxes not paid by the closing date will be charged a 10 penalty. Please note that your tax bill may differ from the results given by this application because you may also be charged local special assessment fees. The Tax Rates in the list below are certified for the listed year as approved by the Geauga County Budget Commission certified by each taxing district to the County Auditor with the effective tax rates as certified by the Department of Tax Equalization applied in December of their respective years. No warranties expressed or implied are provided for the data herein its use or its interpretation. Please call our office at 330-297-3586 with questions and for additional information.

Source: realtor.com

Source: realtor.com

In accordance with state law property taxes are billed at the end of the year in which they are assessed. The purpose of a Triennial update is to provide a buffer for the six year appraisals. You can contact the Geauga County Assessor for. The Geauga County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Geauga County Ohio. Paying your property tax.

Source: pinterest.com

Source: pinterest.com

2nd Half 2016 Real Estate taxes due. 2nd Half 2017 Manufactured Home bills are sent to taxpayers. Taxes not paid by the closing date will be charged a 10 penalty. 2nd Half 2016 Real Estate taxes due. Taxes are typically billed in January first half and June second half of each year and are always due on the second Wednesday of February and the second Wednesday of July.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title geauga county real estate tax due dates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.