Your Hanover county real estate tax rate images are ready in this website. Hanover county real estate tax rate are a topic that is being searched for and liked by netizens now. You can Download the Hanover county real estate tax rate files here. Get all royalty-free images.

If you’re looking for hanover county real estate tax rate pictures information related to the hanover county real estate tax rate interest, you have come to the ideal site. Our site always gives you hints for refferencing the highest quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

Hanover County Real Estate Tax Rate. 0830 AM - 0430 PM. Federal income taxes are not included Property Tax Rate. New Hanover County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. 1845 148 1993.

California Property Taxes Real Estate Taxes Explained List Of Counties Lukinski Real Estates From lukinski.com

California Property Taxes Real Estate Taxes Explained List Of Counties Lukinski Real Estates From lukinski.com

Singlewide and doublewide mobile homes are considered real property provided their tongue and axles have been. 1379 The property tax rate shown here is the rate per 1000 of home value. Hanover Real Estate Tax Assessments. Below is a comparison of our tax rates from 2000 to the present. Pender Central FD. Assessed value is 10 of original capitalized cost excluding capitalized interest.

Real property is defined as land and everything attached to it along with the rights of ownership.

Singlewide and doublewide mobile homes are considered real property provided their tongue and axles have been. 357 per 100 of assessed value. Fair market value is defined as the amount a property would likely sell for today if it were on the market for a reasonable time. How many rates are there. At the present time the Town has five separate and distinct tax rates. The 2019 base tax rate for Hanover is 1845 and is broken down as follows.

Source: lukinski.com

Source: lukinski.com

357 per 100 of assessed value. Below is a comparison of our tax rates from 2000 to the present. 357 per 100 of assessed value. The aggregate rate for sales tax in the DuPage portion of the Village is 775. And what are they.

Source:

Source:

1379 The property tax rate shown here is the rate per 1000 of home value. The 2019 base tax rate for Hanover is 1845 and is broken down as follows. Real property is defined as land and everything attached to it along with the rights of ownership. 13 Zeilen Tax Description Hanover County Assessment Ratio per 100 of Assessed Value. 357 The total of all income taxes for an area including state county and local taxes.

Source: lukinski.com

Source: lukinski.com

A per capita tax is a flat rate tax equally levied on all adult residents within a taxing district. Business Personal Property Tax. 1845 148 1993. Local Services Tax LST. The median property tax also known as real estate tax in Hanover County is 192200 per year based on a median home value of 28160000 and a median effective property tax rate of 068 of property value.

Source: realtor.com

Source: realtor.com

The median property tax also known as real estate tax in Hanover County is 192200 per year based on a median home value of 28160000 and a median effective property tax rate of 068 of property value. Fair market value is defined as the amount a property would likely sell for today if it were on the market for a reasonable time. Houses 7 days ago The Code of Virginia Title 581-3201 states that real estate is to be assessed at 100 of fair market value. The aggregate rate for sales tax in the DuPage portion of the Village is 775. Property taxes are determined at local levels being used for schools fire and police protection public parks and other benefits.

Source: century21core.com

Source: century21core.com

New Hanover County. Median Property Taxes No Mortgage 1951. Unincorporated Fire District. New Hanover County. Tax Rate Per 1000 Town Clerk.

Source: lukinski.com

Source: lukinski.com

357 per 100 of assessed value. Hanover County Property Tax Payments Annual Hanover County Virginia. The Virginia Tax Code represents the main legal document regarding taxation. SEE Detailed property tax report for 10425 Old Telegraph Rr Hanover County VA. Median Property Taxes No Mortgage 1951.

Source: lukinski.com

Source: lukinski.com

New Hanover County North Carolina. New Hanover County. Real estate taxes are billed twice a year due on June 5 and October 5. New Hanover County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Below is a comparison of our tax rates from 2000 to the present.

Source: mrwilliamsburg.com

Source: mrwilliamsburg.com

Median Property Taxes Mortgage 1921. Below is a comparison of our tax rates from 2000 to the present. A per capita tax is a flat rate tax equally levied on all adult residents within a taxing district. If the tax rate is 1400 and the home value is 250000 the property tax. 357 The total of all income taxes for an area including state county and local taxes.

Source:

Source:

357 per 100 of assessed value. How many rates are there. The aggregate rate for sales tax in the DuPage portion of the Village is 775. Median Property Taxes No Mortgage 1951. At the present time the Town has five separate and distinct tax rates.

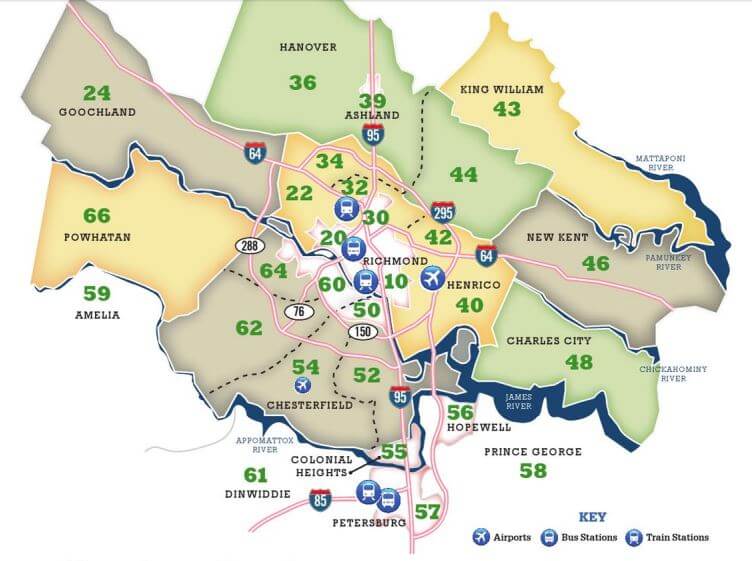

Source: richmondhouselistings.com

Source: richmondhouselistings.com

357 The total of all income taxes for an area including state county and local taxes. The median property tax also known as real estate tax in New Hanover County is 139400 per year based on a median home value of 22780000 and a median effective property tax rate of 061 of property value. A per capita tax is a flat rate tax equally levied on all adult residents within a taxing district. New Hanover County. The Virginia Tax Code represents the main legal document regarding taxation.

Source: realtor.com

Source: realtor.com

Hanover Real Estate Tax Assessments. 1845 148 1993. Taxes on sales of general merchandise within Hanover Park vary by county. 600 The total of all sales taxes for an area including state county and local taxes Income Taxes. 068 of home value Yearly median tax in Hanover County The median property tax in Hanover County Virginia is 1922 per year for a home worth the median value of 281600.

Source: lukinski.com

Source: lukinski.com

New Hanover County. The median property tax also known as real estate tax in New Hanover County is 139400 per year based on a median home value of 22780000 and a median effective property tax rate of 061 of property value. Machinery Tools Tax. Federal income taxes are not included Property Tax Rate. SEE Detailed property tax report for 10425 Old Telegraph Rr Hanover County VA.

Source: zillow.com

Source: zillow.com

How many rates are there. At the present time the Town has five separate and distinct tax rates. 357 per 100 of assessed value. Houses 5 days ago Real Estate Assessments Hanover County VA. The Virginia Tax Code represents the main legal document regarding taxation.

Source: pinterest.com

Source: pinterest.com

2505 603-632-5001 Ext. Tax Rates for Hanover PA. Real estate taxes are billed twice a year due on June 5 and October 5. SEE Detailed property tax report for 10425 Old Telegraph Rr Hanover County VA. Hanover Real Estate Tax Assessments.

Source: lukinski.com

Source: lukinski.com

357 per 100 of assessed value. Assessed value is 10 of original capitalized cost excluding capitalized interest. Tax Rates for Hanover PA. 1379 The property tax rate shown here is the rate per 1000 of home value. Hanover County collects on average 068 of a propertys assessed fair market value as property tax.

Source: lukinski.com

Source: lukinski.com

Each adult resident pays 1500 annually with 1000 sent to the School District and 500 sent to the Township. It is not dependent upon employment. Fair market value is defined as the amount a property would likely sell for today if it were on the market for a reasonable time. The aggregate rate for sales tax in the DuPage portion of the Village is 775. 081 per 100 of assessed value.

Source: realtor.com

Source: realtor.com

Median Property Taxes No Mortgage 1951. Real property is defined as land and everything attached to it along with the rights of ownership. Unincorporated Fire District. 1 days ago The median property tax also known as real estate tax in New Hanover County is 139400 per year based on a median home value of 22780000 and a median effective property tax rate of 061 of property value. Attachments or improvements can be in the form of houses outbuildings decks piersdocks bulkheads or any number of other items permanently attached to the land.

Source: pennlive.com

Source: pennlive.com

Taxes on sales of general merchandise within Hanover Park vary by county. The median property tax also known as real estate tax in New Hanover County is 139400 per year based on a median home value of 22780000 and a median effective property tax rate of 061 of property value. Assessed value is 10 of original capitalized cost excluding capitalized interest. New Hanover County North Carolina. Hanover County collects on average 068 of a propertys assessed fair market value as property tax.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title hanover county real estate tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.