Your Horry county real estate tax rate images are available in this site. Horry county real estate tax rate are a topic that is being searched for and liked by netizens today. You can Find and Download the Horry county real estate tax rate files here. Find and Download all free photos and vectors.

If you’re searching for horry county real estate tax rate pictures information related to the horry county real estate tax rate interest, you have visit the ideal site. Our website always gives you suggestions for seeking the maximum quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

Horry County Real Estate Tax Rate. Property Tax Rates by County 2019. In addition the Myrtle Beach area has one of the lowest property tax rates in the state of South Carolina. These formulas will give you an estimate on your real estate taxes in Horry County South Carolina. The Assessment Ratio is based on the type of property as well as type of ownership.

Painting Your Way To A Faster More Profitable Home Sale Keller Williams The Trembley Group Blue Gray Paint Colors Blue Gray Paint Grey Paint From in.pinterest.com

Painting Your Way To A Faster More Profitable Home Sale Keller Williams The Trembley Group Blue Gray Paint Colors Blue Gray Paint Grey Paint From in.pinterest.com

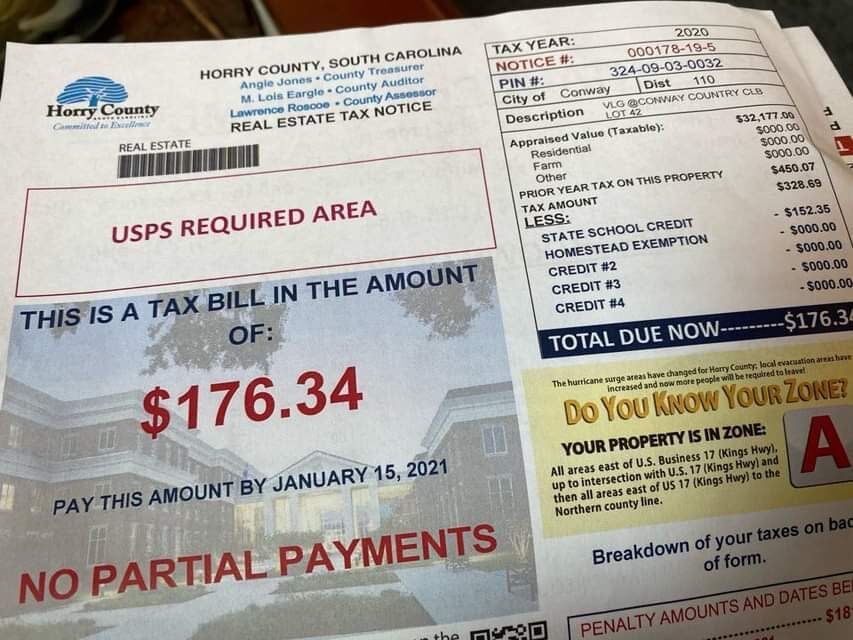

At that rate taxes on a home with a full market value of 200000 would be only 760 per year. Assessed Value x 1049 School Credit Tax Credit. These formulas will give you an estimate on your real estate taxes in Horry County South Carolina. Property Tax Rates by County 2017. Browse the Horry County SC sales tax rate on our Tax Rates database and learn more about high income and inflation adjustments. Millage Rates Horry Georgetown County South Carolina Millage Rates May Not Be Current Taxable Value x 04 Primary Residence Assessed Value x Millage Rate per your District Gross Tax.

Determine approximately 82 of the countys property tax base.

Property Tax Rates by County. Industrial ratio is 10. All real property is assessed at a four percent owner occupied primary residence four or six percent farm or a six percent all other rate. Maintain inventory of all real estate in Horry County depicting land ownership boundaries along with data records showing ownerships legal descriptions and tax districts. Horry County property taxes are calculated by a variety of factors and based on the fair market value of said property and paid in arrears paid for the previous year. If you are a legal resident of Horry county your condo or home as well as up to 5 acres of surrounding land is assessed at market value multiplied by 4 which is then multiplied by the millage rate millage rates can vary by location.

![]() Source: acerealtysc.com

Source: acerealtysc.com

Property Tax Rates by County 2015. Real Estate Tax Rates in Horry County. All real property is assessed at a four percent owner occupied primary residence four or six percent farm or a six percent all other rate. Property Tax Rates by County 2016. Property Tax Rates by County 2019.

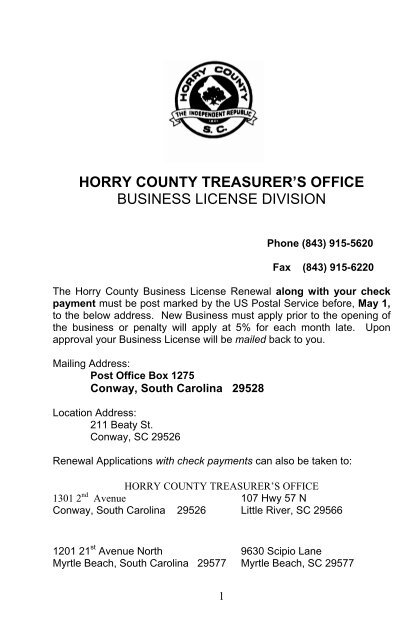

Source: yumpu.com

Source: yumpu.com

The median property tax on a 17010000 house is 85050 in South Carolina. Horry County collects on average 041 of a propertys assessed fair market value as property tax. Property Tax Rates by County 2017. The Assessment Ratio is based on the type of property as well as type of ownership. There is more good news.

Welcome to the Horry County Tax Payment Website. Property Tax Rates by County 2014. Property Tax Rates by County 2020. Paid Receipts Internet Phone will be available after 48 hours from date of payment. For additional information you can reach the Horry County Tax Assessors office at 843-915-5040.

Source: myrtlebeachrealestategroup.com

Source: myrtlebeachrealestategroup.com

Real Estate Tax Rates in Horry County. Property Tax Rates by County 2020. The Assessment Ratio is based on the type of property as well as type of ownership. Property Tax Rates by County 2016. All real property is assessed at a four percent owner occupied primary residence four or six percent farm or a six percent all other rate.

Source: pinterest.com

Source: pinterest.com

Horry County collects on average 041 of a propertys assessed fair market value as property tax. See other fees below. The average effective property tax rate in Horry County is just 038 lowest in the state. The current ratio for primary home ownership is 4. You may want to check out Horry County.

Source: postandcourier.com

Source: postandcourier.com

All real property is assessed at a four percent owner occupied primary residence four or six percent farm or a six percent all other rate. Determine approximately 82 of the countys property tax base. Unfortunately we have no tax rate information for this propertys tax area. How to Compute Real Estate Tax. Property Tax Rates by County 2019.

Source: in.pinterest.com

Source: in.pinterest.com

700 The total of all sales taxes for an area including state county and local taxes. 1301 2nd Ave Ste 1C09. In this video Mark Gouhin with REMAX breaks down how to determine your annual property taxes in Horry C. The current ratio for primary home ownership is 4. Horry County South Carolina.

Source: myrtlebeachhomesblog.com

Source: myrtlebeachhomesblog.com

In addition the Myrtle Beach area has one of the lowest property tax rates in the state of South Carolina. See other fees below. 041 of home value Yearly median tax in Horry County The median property tax in Horry County South Carolina is 696 per year for a home worth the median value of 170100. Horry County South Carolina. You may want to check out Horry County.

Source: in.pinterest.com

Source: in.pinterest.com

Paid Receipts Internet Phone will be available after 48 hours from date of payment. Property Tax Rates by County 2019. Horry County property taxes are calculated by a variety of factors and based on the fair market value of said property and paid in arrears paid for the previous year. The median property tax on a 17010000 house is 178605 in the United States. There is more good news.

Source: horrycounty.org

Source: horrycounty.org

Property Tax Rates by County 2015. Property Tax Rates by County 2020. Maintain inventory of all real estate in Horry County depicting land ownership boundaries along with data records showing ownerships legal descriptions and tax districts. Property is also cheap to own. Horry County Treasurers office.

Source: myrtlebeachhomesblog.com

Source: myrtlebeachhomesblog.com

How does Horry County calculate Property Tax Rates. Horry County South Carolina. At that rate taxes on a home with a full market value of 200000 would be only 760 per year. Therefore property taxes are determined by multiplying the fair market value times the assessment ratio times the millage rate. Determine approximately 82 of the countys property tax base.

Source: horrycounty.org

Source: horrycounty.org

The median property tax on a 17010000 house is 178605 in the United States. Unfortunately we have no tax rate information for this propertys tax area. Horry County South Carolina. Industrial ratio is 10. Out-of-country or installment payments are not accepted online or by phone.

Source: pinterest.com

Source: pinterest.com

We are therefore unable to calculate how much property tax is payable. Property Tax Rates by County 2019. Millage Rates Horry Georgetown County South Carolina Millage Rates May Not Be Current Taxable Value x 04 Primary Residence Assessed Value x Millage Rate per your District Gross Tax. Industrial ratio is 10. Unfortunately we have no tax rate information for this propertys tax area.

Source: myhorrynews.com

Source: myhorrynews.com

South Carolina levies an average of 05 property tax on its residents and Horry County comes in even cheaper at an average of 038 placing it firmly on the list of states with the lowest property taxes. Property Tax Rates by County. Property Tax Rates by County 2013. The average effective property tax rate in Horry County is just 038 lowest in the state. Unfortunately we have no tax rate information for this propertys tax area.

Source: in.pinterest.com

Source: in.pinterest.com

The Fair Market Value is taxed at an assessment ratio and the county is divided into districts which are taxed by a millage rate which are the amount of mills levied in order to meet the budget of a school district. Property Tax Rates by County 2013. If you are a legal resident of Horry county your condo or home as well as up to 5 acres of surrounding land is assessed at market value multiplied by 4 which is then multiplied by the millage rate millage rates can vary by location. The median property tax on a 17010000 house is 69741 in Horry County. All real property is assessed at a four percent owner occupied primary residence four or six percent farm or a six percent all other rate.

Source: postandcourier.com

Source: postandcourier.com

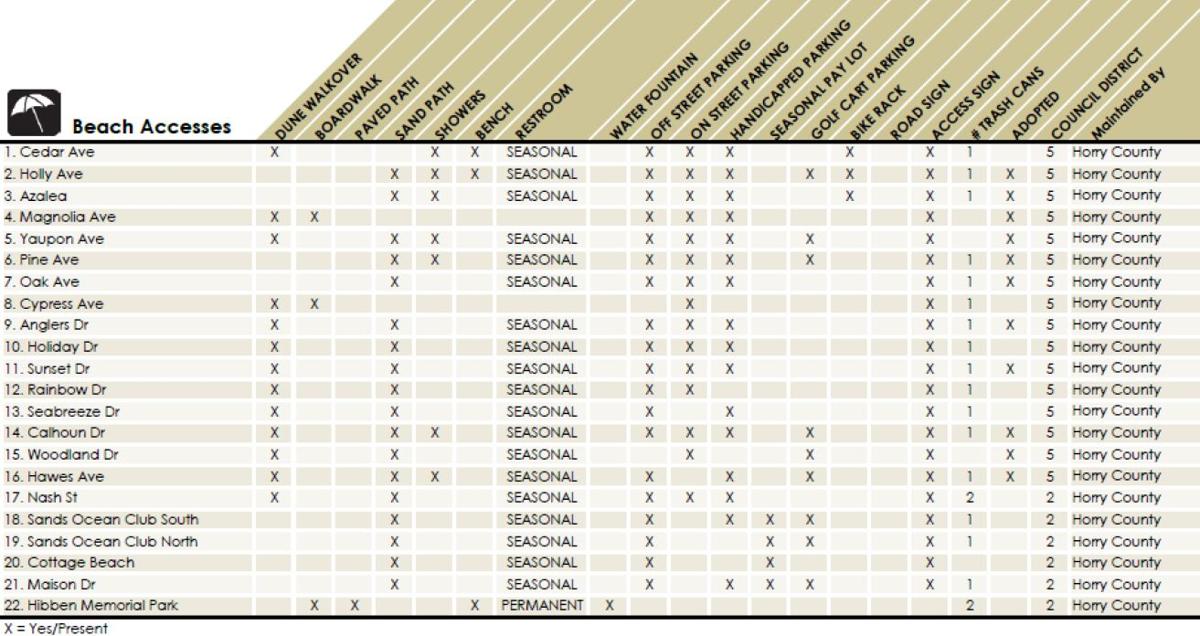

Property Tax Rates by County 2016. Tax Rates for Horry SC Sales Taxes. Most people want to know what their real estate taxes will be when they purchase property. Property is also cheap to own. Appraise and list all real property for taxation that is located in Horry County excepting real property that is assessed by the Department of Revenue.

Source: wpde.com

Source: wpde.com

For additional information you can reach the Horry County Tax Assessors office at 843-915-5040. Property Tax Rates by County 2018. Browse the Horry County SC sales tax rate on our Tax Rates database and learn more about high income and inflation adjustments. Tax Rates for Horry SC Sales Taxes. 1301 2nd Ave Ste 1C09.

![]() Source: acerealtysc.com

Source: acerealtysc.com

1301 2nd Ave Ste 1C09. Welcome to the Horry County Tax Payment Website. South Carolina levies an average of 05 property tax on its residents and Horry County comes in even cheaper at an average of 038 placing it firmly on the list of states with the lowest property taxes. Horry County collects on average 041 of a propertys assessed fair market value as property tax. Taxes are calculated on the assessed value of your home and your districts Horry County millage rate.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title horry county real estate tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.