Your How does depreciation work in real estate images are available. How does depreciation work in real estate are a topic that is being searched for and liked by netizens now. You can Find and Download the How does depreciation work in real estate files here. Find and Download all free photos and vectors.

If you’re looking for how does depreciation work in real estate images information connected with to the how does depreciation work in real estate keyword, you have come to the ideal site. Our site always provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

How Does Depreciation Work In Real Estate. This benefit allows both residential rental property and commercial property owners to significantly reduce their taxes. At some point you may decide to sell your rental property. But at a potentially reduced rate. These will definitely include the current markets.

P5bhdam148mtmm From

P5bhdam148mtmm From

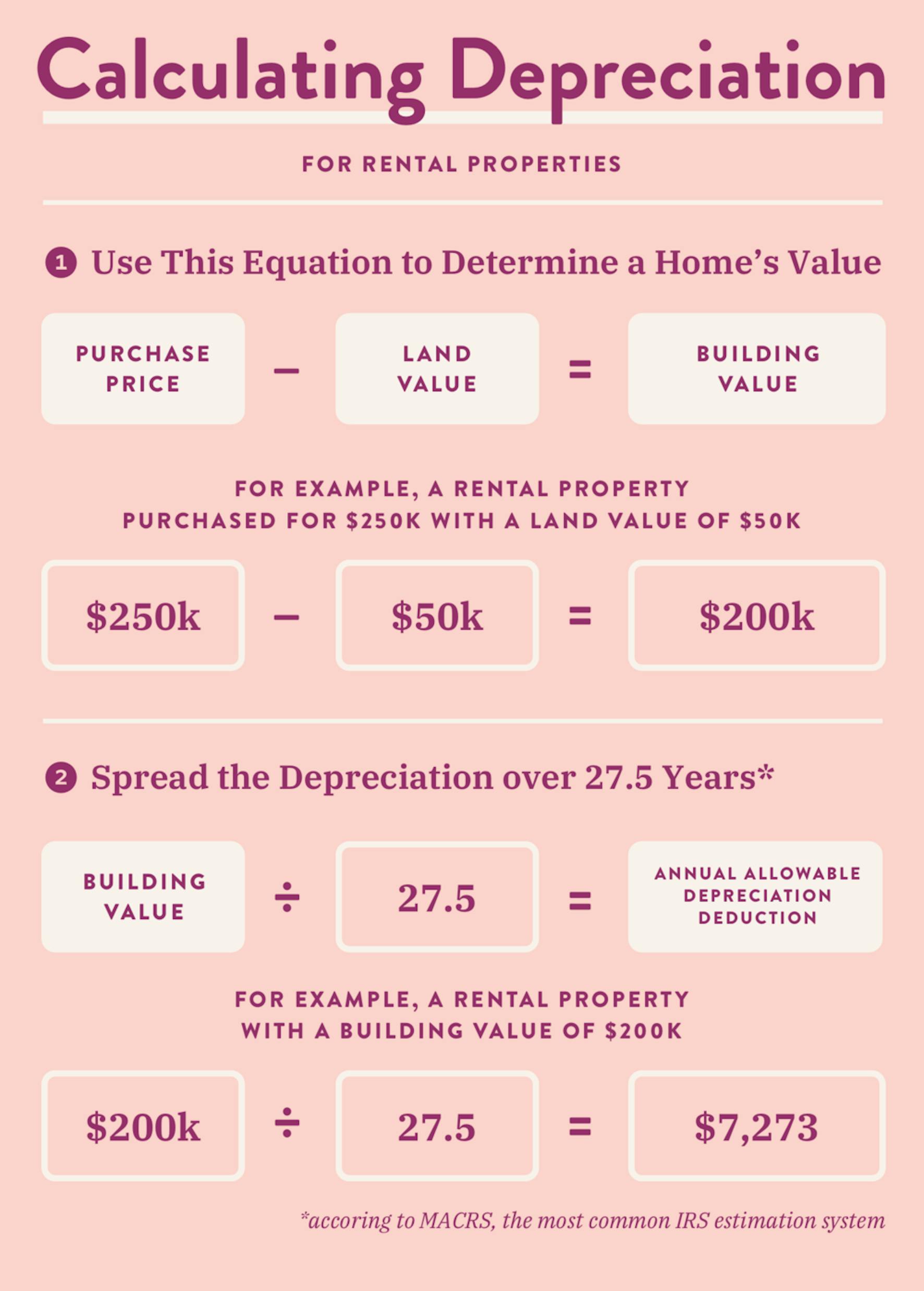

How does depreciation recapture work on rental property. Its a tax deduction that lowers your income so if youre in the 24 tax bracket and deduct 5000 in depreciation on your rental. Simply put real estate investment property depreciation is a big benefit that helps to make it all worthwhile for investors. The basis of the property is its cost or the amount you paid in cash with a. Understand Depreciation in Real Estate Investing - YouTube. Depreciation occurs when the property has diminished in value due to time environment and damage.

Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl.

The basis of the property is its cost or the amount you paid in cash with a. Depreciation however reduces your overall tax liability. The IRS will demand that you pay a premium on that portion of your gain. Simply put real estate investment property depreciation is a big benefit that helps to make it all worthwhile for investors. Commercial real estate depreciation lets investors expense the cost of income producing property over time lower the amount of personal income tax paid and even roll over and defer the. It is a great resource for lowering the taxable income that investors make from properties.

Source: realestate.com.au

Source: realestate.com.au

The govt just came up with the period of time. Understanding Real Estate Tax Benefits. Depreciation occurs when the property has diminished in value due to time environment and damage. This is the price you pay for property less the land value. If playback doesnt.

Source: youtube.com

Source: youtube.com

Simply put real estate investment property depreciation is a big benefit that helps to make it all worthwhile for investors. These will definitely include the current markets. Instead of making the deduction in the year you purchase or improve your property the depreciation deduction is divided out across the. Depreciation is when the taxpayer subtracts the cost of buying and improving rental property from the taxes you pay. At some point you may decide to sell your rental property.

Source: bmtqs.com.au

Source: bmtqs.com.au

When you file your taxes rent and expenses get entered on a Schedule. When used in the context of investment real estate Depreciation refers to an allocation of the propertys cost over its useful life. You may have to pay it back later if you sell. Key takeaways for commercial real estate depreciation. For example the value of the land will depreciate if the adjacent land was made into a.

Source: wealthfit.com

Source: wealthfit.com

It is a great resource for lowering the taxable income that investors make from properties. At some point you may want to sell your rental property. Depreciation occurs when the property has diminished in value due to time environment and damage. If you dont know what depreciation means it just simply means the loss of value of an asset due to changes in the market condition or due to wear and tear. For example the value of the land will depreciate if the adjacent land was made into a.

Source: investopedia.com

Source: investopedia.com

For example the value of the land will depreciate if the adjacent land was made into a. This is the price you pay for property less the land value. Depreciation is when the taxpayer subtracts the cost of buying and improving rental property from the taxes you pay. Understand Depreciation in Real Estate Investing - YouTube. Understanding Real Estate Tax Benefits.

Source: investopedia.com

Source: investopedia.com

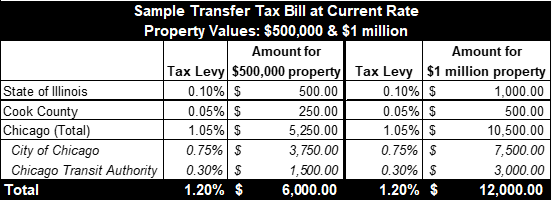

Separate the cost of land and buildings. On real estate you buy and rent out the govt allows you to take a portion of depreciation each year of an equal amount. Understanding Real Estate Tax Benefits. The basis of the property is its cost or the amount you paid in cash with a. At some point you may decide to sell your rental property.

Source: trion-properties.com

Source: trion-properties.com

Depreciation is when the taxpayer subtracts the cost of buying and improving rental property from the taxes you pay. For example the value of the land will depreciate if the adjacent land was made into a. It is a great resource for lowering the taxable income that investors make from properties. How does depreciation recapture work on rental property. Simply put real estate investment property depreciation is a big benefit that helps to make it all worthwhile for investors.

Source: bench.co

Source: bench.co

The govt just came up with the period of time. On real estate you buy and rent out the govt allows you to take a portion of depreciation each year of an equal amount. Determine the basis of the property. Separate the cost of land and buildings. It is a great resource for lowering the taxable income that investors make from properties.

Source: investopedia.com

Source: investopedia.com

Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl. It is a great resource for lowering the taxable income that investors make from properties. Understanding Real Estate Tax Benefits. At some point you may want to sell your rental property. But at a potentially reduced rate.

Source: wilsonpateras.com.au

Source: wilsonpateras.com.au

Separate the cost of land and buildings. If you bought a house and it was worth 100000 but then the market has taken a downturn and all of a sudden things went downhill and now that house instead of being worth 100000 is now worth 50000. When you file your taxes rent and expenses get entered on a Schedule. Depreciation however reduces your overall tax liability. The remaining is then depreciated over 27 and one half years.

Source: iqcalculators.com

Source: iqcalculators.com

The basis of the property is its cost or the amount you paid in cash with a. Its a tax deduction that lowers your income so if youre in the 24 tax bracket and deduct 5000 in depreciation on your rental. There are many things that are figured into the value of your home. On real estate you buy and rent out the govt allows you to take a portion of depreciation each year of an equal amount. Determine the basis of the property.

Source: bmtqs.com.au

Source: bmtqs.com.au

How does depreciation recapture work on rental property. This benefit allows both residential rental property and commercial property owners to significantly reduce their taxes. Because depreciation expenses lower your cost basis in the property they ultimately determine your gain or loss when you sell. The govt just came up with the period of time. Depreciation however reduces your overall tax liability.

Source: wealthfit.com

Source: wealthfit.com

At some point you may decide to sell your rental property. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl. Depreciation however reduces your overall tax liability. If you dont know what depreciation means it just simply means the loss of value of an asset due to changes in the market condition or due to wear and tear. The IRS will demand that you pay a premium on that portion of your gain.

Source: retipster.com

Source: retipster.com

For example the value of the land will depreciate if the adjacent land was made into a. These will definitely include the current markets. Key takeaways for commercial real estate depreciation. But at a potentially reduced rate. You may have to pay it back later if you sell.

Source: stessa.com

Source: stessa.com

Separate the cost of land and buildings. At some point you may want to sell your rental property. Key takeaways for commercial real estate depreciation. You may have to pay it back later if you sell without exchanging. But at a potentially reduced rate.

Source: investopedia.com

Source: investopedia.com

While its always recommended that you work with a qualified tax accountant when calculating depreciation here are the basic steps. Depreciation allows you to spread the tax benefit of qualifying expenses over the lifetime of whatever improvement youve made. The govt just came up with the period of time. Key takeaways for commercial real estate depreciation. Instead of making the deduction in the year you purchase or improve your property the depreciation deduction is divided out across the.

Source: fool.com

Source: fool.com

Depreciation is when the taxpayer subtracts the cost of buying and improving rental property from the taxes you pay. 2 days ago In the simplest of terms depreciation is the reduction in value of an asset as it ages. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl. Because physical assets wear out over time the IRS allows for income tax deductions over time in order to account for the propertys loss of utility. Depreciation is defined as a decrease in the value of your property over time.

Source:

Source:

2 days ago In the simplest of terms depreciation is the reduction in value of an asset as it ages. Depreciation however reduces your overall tax liability. At some point you may decide to sell your rental property. Simply put real estate investment property depreciation is a big benefit that helps to make it all worthwhile for investors. If playback doesnt.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how does depreciation work in real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.