Your How to depreciate commercial real estate images are available. How to depreciate commercial real estate are a topic that is being searched for and liked by netizens now. You can Download the How to depreciate commercial real estate files here. Download all royalty-free photos and vectors.

If you’re searching for how to depreciate commercial real estate images information connected with to the how to depreciate commercial real estate interest, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

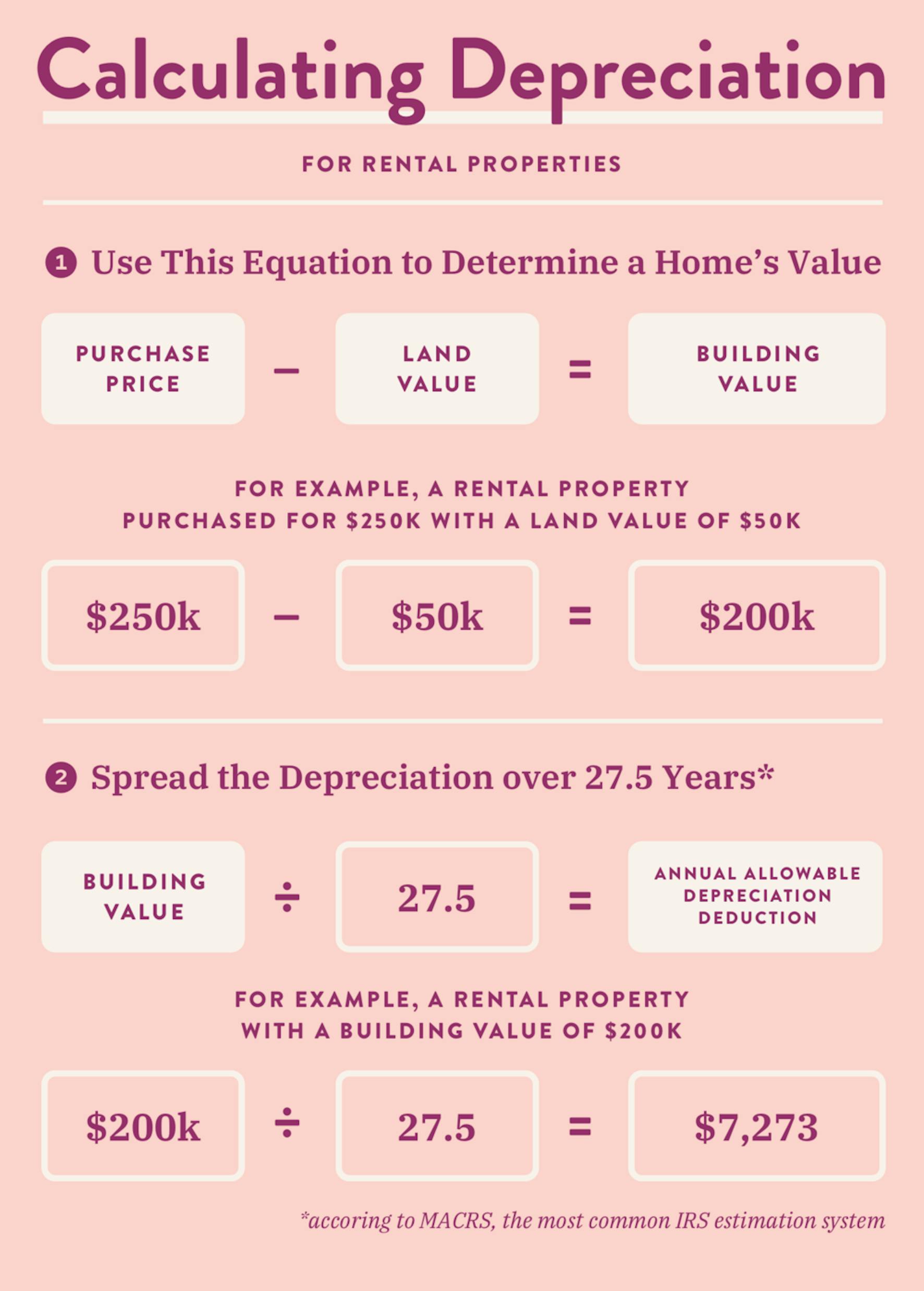

How To Depreciate Commercial Real Estate. The Internal Revenue Service IRS allows building owners the opportunity under the Modified Accelerated Cost Recovery System MACRS to depreciate certain land improvements and personal. Using a straight line depreciation method for a commercial property costing 2 million dollars for example you would receive an annual deduction of 51282 2M 39 51282. How Bonus Depreciation Affects Rental Properties. The IRS depreciates residential rental buildings over 275 years and retail and other commercial.

Commercial Property Depreciation Guide For Investors Millionacres From fool.com

Commercial Property Depreciation Guide For Investors Millionacres From fool.com

Understanding Commercial Real Estate Depreciation Than. Specifically commercial real estate investors utilize an accounting tool called cost segregation or cost segs. The Internal Revenue Service IRS allows building owners the opportunity under the Modified Accelerated Cost Recovery System MACRS to depreciate certain land improvements and personal. To account for this the IRS allows individuals to allocate the cost of an asset over its life expectancy. The basis of a property is essentially its acquisition cost minus the. You must generally use MACRS to depreciate real property that you acquired for personal use before 1987 and changed to business or income-producing use after 1986.

Since theres no way of knowing how long a rental property will.

Houses 4 days ago Commercial Real Estate Depreciation Calculator. Heres what it is and. Since theres no way of knowing how long a rental property will. In the simplest of terms depreciation is the reduction in value of an asset as it ages. The Internal Revenue Service IRS allows building owners the opportunity under the Modified Accelerated Cost Recovery System MACRS to depreciate certain land improvements and personal. Accelerating depreciation is the primary method investors can use to recapture their investments quickly.

Source: br.pinterest.com

Source: br.pinterest.com

Separate the commercial property asset using an engineering report into four separate categories. If playback doesnt begin shortly try restarting your device. Your annual net income is thereby reduced by that amount for tax purposes reducing the. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl. Heres what it is and.

Source: br.pinterest.com

Source: br.pinterest.com

The first step in determining the amount commercial real estate owners may depreciate their property by each year is to calculate the assets basis. Personal property land improvements the building and land. Bonus depreciation benefits small businesses and allows them to depreciate a larger-than-normal portion of business assets. Your annual net income is thereby reduced by that amount for tax purposes reducing the. The purpose of this tool is to take advantage of significant tax benefits.

Source: pinterest.com

Source: pinterest.com

While the cost of the actual land is excluded from the basis commercial renters may include things like settlement. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl. Because commercial real estate is considered an asset rather than an expense the Internal Revenue Service wont let you write off its cost in the year you buy it. Another way to calculate the new basis is to take the cost of the replacement property and subtract the gain that is deferred in the like-kind exchange. How Bonus Depreciation Affects Rental Properties.

Source:

Source:

In the simplest of terms depreciation is the reduction in value of an asset as it ages. While the cost of the actual land is excluded from the basis commercial renters may include things like settlement. Real estate investors can depreciate the cost of the building but not the land its on over the useful life of the property. If the property is a commercial property then the depreciation period is 39 years as opposed to 275 years for residential property. Personal property land improvements the building and land.

Source: id.pinterest.com

Source: id.pinterest.com

The taxpayer decides to complete a like-kind exchange for this sale. Because commercial real estate is considered an asset rather than an expense the Internal Revenue Service wont let you write off its cost in the year you buy it. Bonus depreciation benefits small businesses and allows them to depreciate a larger-than-normal portion of business assets. Since theres no way of knowing how long a rental property will. Heres what it is and.

Source: pinterest.com

Source: pinterest.com

Bonus depreciation benefits small businesses and allows them to depreciate a larger-than-normal portion of business assets. Instead the agency requires you. Your annual net income is thereby reduced by that amount for tax purposes reducing the. You must generally use MACRS to depreciate real property that you acquired for personal use before 1987 and changed to business or income-producing use after 1986. Personal property land improvements the building and land.

Source: pinterest.com

Source: pinterest.com

You must generally use MACRS to depreciate real property that you acquired for personal use before 1987 and changed to business or income-producing use after 1986. Current law requires owners of commercial property purchased after 1993 to deduct 139th of the original cost each year. Cost of property Land value Basis Basis 39 years Annual allowable depreciation expense 1250000 cost of property 250000 land value 1 million basis. The resulting gain is the difference between the selling price and the adjusted tax basis. Improvements made after 1986.

Source: pinterest.com

Source: pinterest.com

Improvements made after 1986. The Internal Revenue Service IRS allows building owners the opportunity under the Modified Accelerated Cost Recovery System MACRS to depreciate certain land improvements and personal. You must generally use MACRS to depreciate real property that you acquired for personal use before 1987 and changed to business or income-producing use after 1986. The basis of a property is essentially its acquisition cost minus the cost of the land land is not depreciable in the eyes of the IRS. Because commercial real estate is considered an asset rather than an expense the Internal Revenue Service wont let you write off its cost in the year you buy it.

Source: pinterest.com

Source: pinterest.com

Depreciation lets you deduct the cost of acquiring an asset in this case real estate over a period of time. The resulting gain is the difference between the selling price and the adjusted tax basis. Another way to calculate the new basis is to take the cost of the replacement property and subtract the gain that is deferred in the like-kind exchange. The taxpayer decides to complete a like-kind exchange for this sale. Understanding Commercial Real Estate Depreciation Than.

Source: fool.com

Source: fool.com

You must treat an improvement made after 1986 to property you placed in service before 1987 as separate depreciable property. Bonus depreciation benefits small businesses and allows them to depreciate a larger-than-normal portion of business assets. Cost Segregation for Accelerated Depreciation - CXRE. In the simplest of terms depreciation is the reduction in value of an asset as it ages. Depreciation lets you deduct the cost of acquiring an asset in this case real estate over a period of time.

Source: pinterest.com

Source: pinterest.com

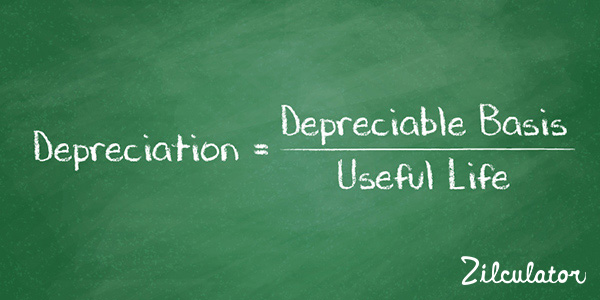

The formula for depreciating commercial real estate looks like this. Videos you watch may be added to the TVs watch history and influence TV recommendations. The formula for depreciating commercial real estate looks like this. Another way to calculate the new basis is to take the cost of the replacement property and subtract the gain that is deferred in the like-kind exchange. The depreciation results in a reduced adjusted tax basis.

Source: zilculator.com

Source: zilculator.com

The Internal Revenue Service IRS allows building owners the opportunity under the Modified Accelerated Cost Recovery System MACRS to depreciate certain land improvements and personal. Improvements made after 1986. Accelerating depreciation is the primary method investors can use to recapture their investments quickly. If the property is a commercial property then the depreciation period is 39 years as opposed to 275 years for residential property. The purpose of this tool is to take advantage of significant tax benefits.

Source: pinterest.com

Source: pinterest.com

You must generally use MACRS to depreciate real property that you acquired for personal use before 1987 and changed to business or income-producing use after 1986. Understanding Commercial Real Estate Depreciation Than. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl. To account for this the IRS allows individuals to allocate the cost of an asset over its life expectancy. The taxpayer decides to complete a like-kind exchange for this sale.

Source: pinterest.com

Source: pinterest.com

The Internal Revenue Service IRS allows building owners the opportunity under the Modified Accelerated Cost Recovery System MACRS to depreciate certain land improvements and personal. Your annual net income is thereby reduced by that amount for tax purposes reducing the. The IRS depreciates residential rental buildings over 275 years and retail and other commercial. Heres what it is and. How Bonus Depreciation Affects Rental Properties.

Source: wealthfit.com

Source: wealthfit.com

Videos you watch may be added to the TVs watch history and influence TV recommendations. In the simplest of terms depreciation is the reduction in value of an asset as it ages. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl. Using a straight line depreciation method for a commercial property costing 2 million dollars for example you would receive an annual deduction of 51282 2M 39 51282. Current law requires owners of commercial property purchased after 1993 to deduct 139th of the original cost each year.

Source: wealthfit.com

Source: wealthfit.com

If playback doesnt begin shortly try restarting your device. Your annual net income is thereby reduced by that amount for tax purposes reducing the. The taxpayer decides to complete a like-kind exchange for this sale. Houses 4 days ago Commercial Real Estate Depreciation Calculator. Specifically commercial real estate investors utilize an accounting tool called cost segregation or cost segs.

Source: realestate.com.au

Source: realestate.com.au

Cost Segregation for Accelerated Depreciation - CXRE. The purpose of this tool is to take advantage of significant tax benefits. You must treat an improvement made after 1986 to property you placed in service before 1987 as separate depreciable property. The first step in determining the amount commercial real estate owners may depreciate their property by each year is to calculate the assets basis. Videos you watch may be added to the TVs watch history and influence TV recommendations.

Source: pinterest.com

Source: pinterest.com

Your annual net income is thereby reduced by that amount for tax purposes reducing the. You must treat an improvement made after 1986 to property you placed in service before 1987 as separate depreciable property. Real Estate Depreciation Explained If youre investing in real estate youve probably heard of depreciation and how you can use it to reduce your taxabl. Commercial and residential building assets can be depreciated either over 39-year straight-line for commercial property or a 275-year straight line for residential property as dictated by the current US. Accelerating depreciation is the primary method investors can use to recapture their investments quickly.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to depreciate commercial real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.