Your How to figure depreciation on real estate images are ready in this website. How to figure depreciation on real estate are a topic that is being searched for and liked by netizens now. You can Find and Download the How to figure depreciation on real estate files here. Get all free photos.

If you’re looking for how to figure depreciation on real estate images information connected with to the how to figure depreciation on real estate topic, you have visit the ideal blog. Our website always gives you hints for seeking the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

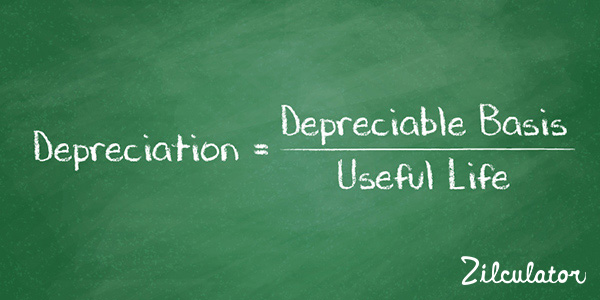

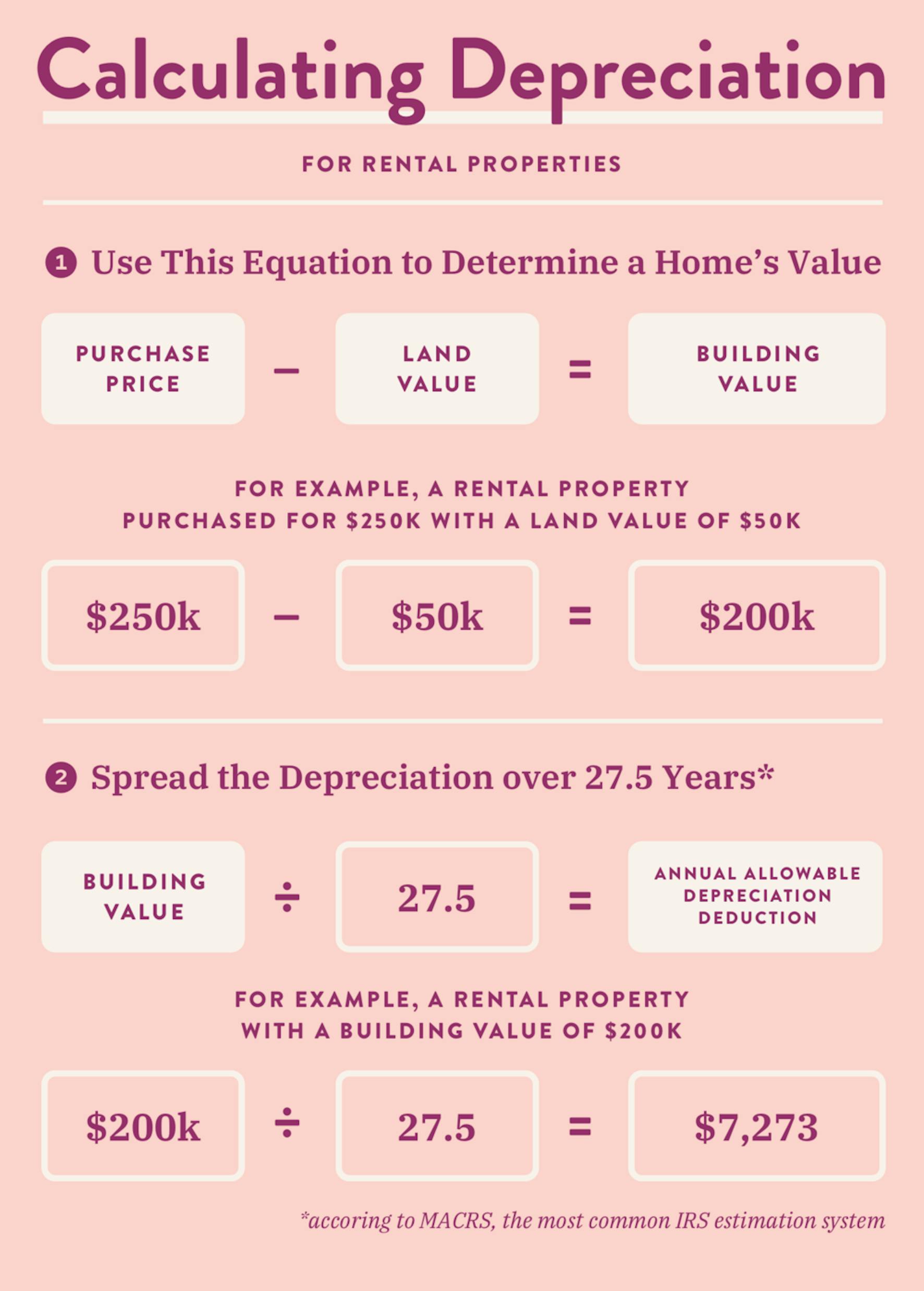

How To Figure Depreciation On Real Estate. Original Value - Land Value Depreciable Basis Useful Life is either 275 years property classified as residential or 390 years property classified as non-residential. One of the many reasons investors love real estate is due to the ability to deduct depreciation from their taxes. The real estate depreciation calculator shows you how much your depreciation is during the course of one year and the propertys useful life according to the general MACRS depreciation method. That means if you have a property worth 200000 you can deduct.

Housing Cycles Real Estate Valuations And Economic Growth Vox Cepr Policy Portal From voxeu.org

Housing Cycles Real Estate Valuations And Economic Growth Vox Cepr Policy Portal From voxeu.org

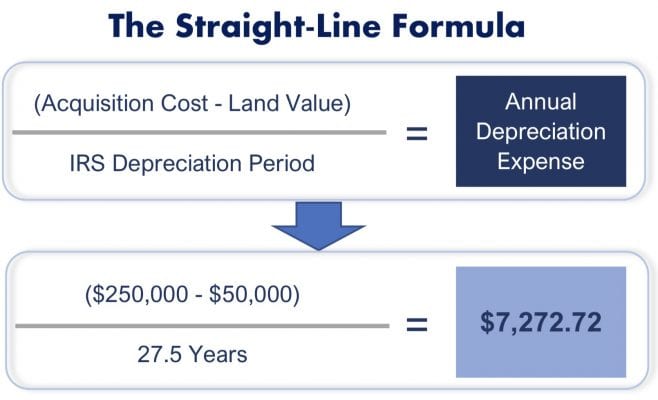

If you want to save money on taxes depreciation is the way to do itHeres what youll learn. The basis of the property is its cost or the amount you paid in cash with a. Cost of property Land value Basis Basis 39 years Annual allowable depreciation expense. For example you buy a below market value property that is in a distressed condition on January 1st. The depreciation process counts from the day on which the investment property was ready for renting out. Figure the depreciation that would have been allowable on the section 179 deduction you claimed.

How to calculate depreciation There are several options to calculate depreciation.

Depreciation is determined by the investors basis in the property the recovery period the time period for which the depreciation is being claimed and the depreciation method used. Figure the depreciation that would have been allowable on the section 179 deduction you claimed. To figure out the value of the land based on the amount you paid multiply the purchase price by 25. Original Value - Land Value Depreciable Basis Useful Life is either 275 years property classified as residential or 390 years property classified as non-residential. To determine the amount of depreciation that an investor can take annually the IRS determines the rate at which investors can depreciate improvements land is not depreciable. If a certain property that cost 180000 can be depreciated using a tax life of 275 years you would divide 180000 by 275 to yield a straight-line equal amount of 6545 in depreciation each year.

Source: realestate.com.au

Source: realestate.com.au

Figure the depreciation that would have been allowable on the section 179 deduction you claimed. That means if you have a property worth 200000 you can deduct. Depreciation in real estate is the process used to deduct the costs of buying and improving a rental property. Now that you understand the basics of real estate appreciation and fair market value its time to move on to how to calculate real estate appreciation. This rate is different for residential and commercial properties.

Source: trion-properties.com

Source: trion-properties.com

If a certain property that cost 180000 can be depreciated using a tax life of 275 years you would divide 180000 by 275 to yield a straight-line equal amount of 6545 in depreciation each year. That means if you. A Simple Example of Straight-Line Depreciation. The depreciation process counts from the day on which the investment property was ready for renting out. Multiply the monthly depreciation amount calculated in Step 3 by the number of months during the tax year that the property was available for rent.

Source: stessa.com

Source: stessa.com

This rate is different for residential and commercial properties. In this example thats 240000 multiplied by 25 or 60000. That is your total depreciation deduction for the. For example you buy a below market value property that is in a distressed condition on January 1st. Multiply the monthly depreciation amount calculated in Step 3 by the number of months during the tax year that the property was available for rent.

Source: rentfaxpro.com

Source: rentfaxpro.com

Residential 275 years maximum and 364 annually. In this example thats 240000 multiplied by 25 or 60000. One of the many reasons investors love real estate is due to the ability to deduct depreciation from their taxes. Original Value - Land Value Depreciable Basis Useful Life is either 275 years property classified as residential or 390 years property classified as non-residential. To figure out the value of the land based on the amount you paid multiply the purchase price by 25.

Source: zilculator.com

Source: zilculator.com

That means if you have a property worth 200000 you can deduct. When it comes to a property the IRS has set 275 years of useful life as the depreciation period for residential real estate. The IRS considers the useful life of a rental property to be 275 years and usually 39 years for commercial property. You renovate the property but the process takes three. Depreciable Basis is the original value of the rental property less the value of the land.

Source: fool.com

Source: fool.com

The basis of the property is its cost or the amount you paid in cash with a. Depreciation in real estate is the process used to deduct the costs of buying and improving a rental property. Subtract the depreciation figured in 1 from the section 179 deduction you claimed. Residential 275 years maximum and 364 annually. Thats your annual depreciation deduction and you didnt spend any extra dimes on costs to get it.

Source: bundesfinanzministerium.de

Source: bundesfinanzministerium.de

One of the many reasons investors love real estate is due to the ability to deduct depreciation from their taxes. Depreciable Basis is the original value of the rental property less the value of the land. The most straightforward one typically used for home improvements is the straight-line method To do it you. Residential 275 years maximum and 364 annually. If you want to save money on taxes depreciation is the way to do itHeres what youll learn.

Source:

Source:

Separate the cost of land and buildings. Multiply the monthly depreciation amount calculated in Step 3 by the number of months during the tax year that the property was available for rent. When it comes to a property the IRS has set 275 years of useful life as the depreciation period for residential real estate. Its yours simply for investing in the. This rate is different for residential and commercial properties.

Source: wealthfit.com

Source: wealthfit.com

Its yours simply for investing in the. Depreciable Basis is the original value of the rental property less the value of the land. There are two steps to calculating real estate appreciation. The depreciation process counts from the day on which the investment property was ready for renting out. If a certain property that cost 180000 can be depreciated using a tax life of 275 years you would divide 180000 by 275 to yield a straight-line equal amount of 6545 in depreciation each year.

Source: baymgmtgroup.com

Source: baymgmtgroup.com

Its yours simply for investing in the. Step 1 Future Growth 1 Annual RateYears. Depreciation in real estate is the process used to deduct the costs of buying and improving a rental property. One of the many reasons investors love real estate is due to the ability to deduct depreciation from their taxes. The basis of the property is its cost or the amount you paid in cash with a.

Source: retipster.com

Source: retipster.com

That means if you. Figure the depreciation that would have been allowable on the section 179 deduction you claimed. That means if you. That means if you have a property worth 200000 you can deduct. To figure out the value of the land based on the amount you paid multiply the purchase price by 25.

Source: investopedia.com

Source: investopedia.com

The real estate depreciation calculator shows you how much your depreciation is during the course of one year and the propertys useful life according to the general MACRS depreciation method. That means if you have a property worth 200000 you can deduct. Multiply the monthly depreciation amount calculated in Step 3 by the number of months during the tax year that the property was available for rent. While its always recommended that you work with a qualified tax accountant when calculating depreciation here are the basic steps. In this example thats 240000 multiplied by 25 or 60000.

Source: breakingintowallstreet.com

Source: breakingintowallstreet.com

How to calculate depreciation There are several options to calculate depreciation. Formula for depreciating commercial real estate The formula for depreciating commercial real estate looks like this. You renovate the property but the process takes three. In this example thats 240000 multiplied by 25 or 60000. Cost of property Land value Basis Basis 39 years Annual allowable depreciation expense.

Source: iqcalculators.com

Source: iqcalculators.com

Residential 275 years maximum and 364 annually. The basis of the property is its cost or the amount you paid in cash with a. Cost of property Land value Basis Basis 39 years Annual allowable depreciation expense. To determine the amount of depreciation that an investor can take annually the IRS determines the rate at which investors can depreciate improvements land is not depreciable. Original Value - Land Value Depreciable Basis Useful Life is either 275 years property classified as residential or 390 years property classified as non-residential.

Source: fool.com

Source: fool.com

When it comes to a property the IRS has set 275 years of useful life as the depreciation period for residential real estate. Determine the basis of the property. Cost of property Land value Basis Basis 39 years Annual allowable depreciation expense. Your cost basis is the. This rate is different for residential and commercial properties.

Source: wealthfit.com

Source: wealthfit.com

Now that you understand the basics of real estate appreciation and fair market value its time to move on to how to calculate real estate appreciation. A Simple Example of Straight-Line Depreciation. If a certain property that cost 180000 can be depreciated using a tax life of 275 years you would divide 180000 by 275 to yield a straight-line equal amount of 6545 in depreciation each year. You renovate the property but the process takes three. When it comes to a property the IRS has set 275 years of useful life as the depreciation period for residential real estate.

Source: voxeu.org

Source: voxeu.org

Thats your annual depreciation deduction and you didnt spend any extra dimes on costs to get it. The basis of the property is its cost or the amount you paid in cash with a. While its always recommended that you work with a qualified tax accountant when calculating depreciation here are the basic steps. Determine the basis of the property. You renovate the property but the process takes three.

Source: bundesfinanzministerium.de

Source: bundesfinanzministerium.de

Determine the basis of the property. Depreciation is determined by the investors basis in the property the recovery period the time period for which the depreciation is being claimed and the depreciation method used. The most straightforward one typically used for home improvements is the straight-line method To do it you. For example you buy a below market value property that is in a distressed condition on January 1st. Separate the cost of land and buildings.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to figure depreciation on real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.