Your Illinois real estate transfer tax exemptions images are ready in this website. Illinois real estate transfer tax exemptions are a topic that is being searched for and liked by netizens today. You can Get the Illinois real estate transfer tax exemptions files here. Download all free photos and vectors.

If you’re searching for illinois real estate transfer tax exemptions pictures information related to the illinois real estate transfer tax exemptions keyword, you have come to the ideal site. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

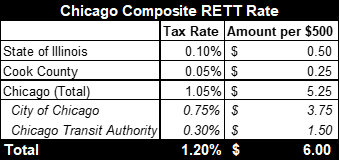

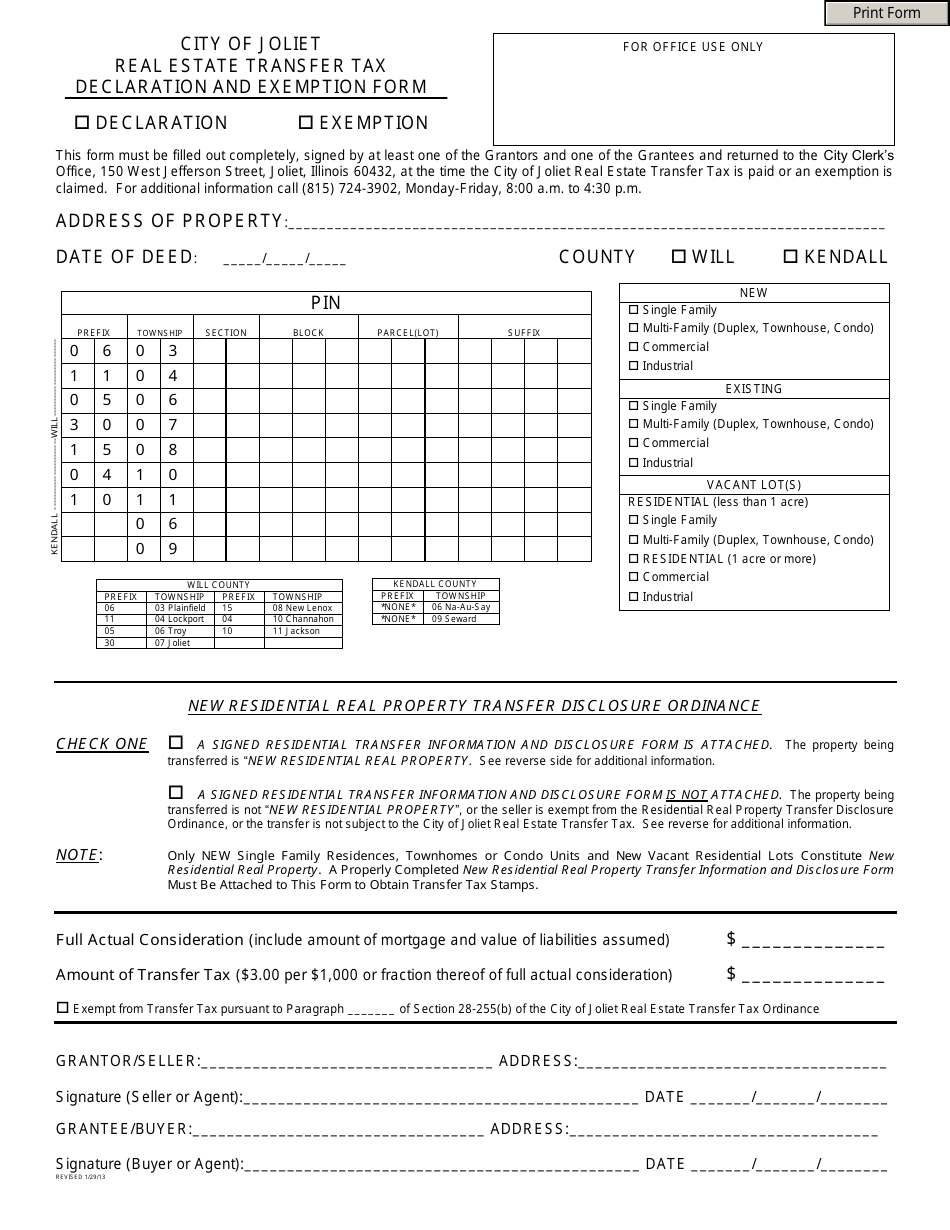

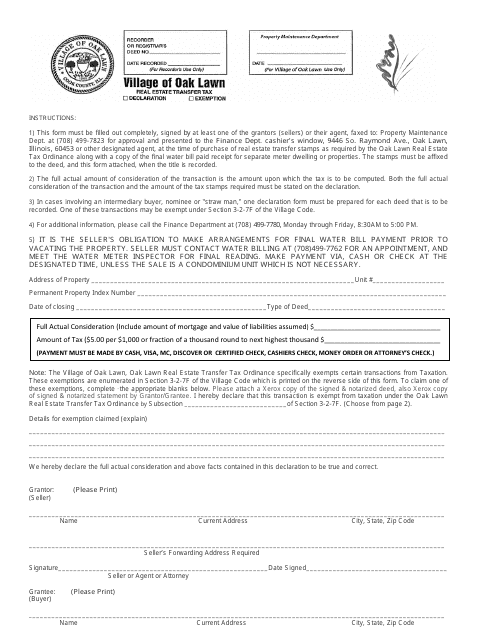

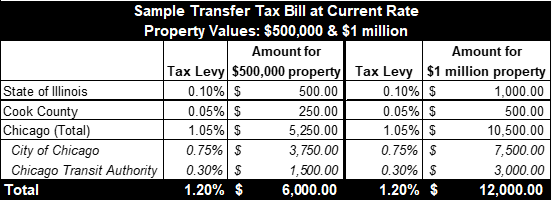

Illinois Real Estate Transfer Tax Exemptions. In addition counties may apply an additional tax of 025 per 500. The property seller or authorized representative must submit a completed Real Estate Transfer Tax Form marked Declaration or Exemption to the Property Maintenance Division at least 5 BUSINESS DAYS prior to the date of the real estate transferproperty closing or exemption recording via email to transferstampsoaklawn-ilgov. This exemption is administered through a refund administered by the Tax Division of the Department of Finance located at 333 South State. There are several exemptions from real estate transfer tax that could apply to all real estate transfers.

MyDec allows you to electronically submit. Illinois Real Estate Transfer Tax on Deeds to Real Estate Houses Just Now Illinois Real Estate Transfer Tax Exemptions that Apply to All Transfers There are several exemptions from real estate transfer tax that could apply to all real estate transfers. A Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date. This exemption is administered through a refund administered by the Tax Division of the Department of Finance located at 333 South State. 35 ILCS 20031-45 a. Can You Deduct Transfer Taxes.

B Deeds to or trust.

Some items which are considered to be exempt from sales tax in the state include. The actual consideration amount paid for the property is less than 100. In addition counties may apply an additional tax of 025 per 500. A Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date. The following transactions are exempt from the transfer tax under 35 ILCS 20031-45. Seller customary Addison 2501000 Village Hall Buyer.

Source: realpropertyalliance.org

Source: realpropertyalliance.org

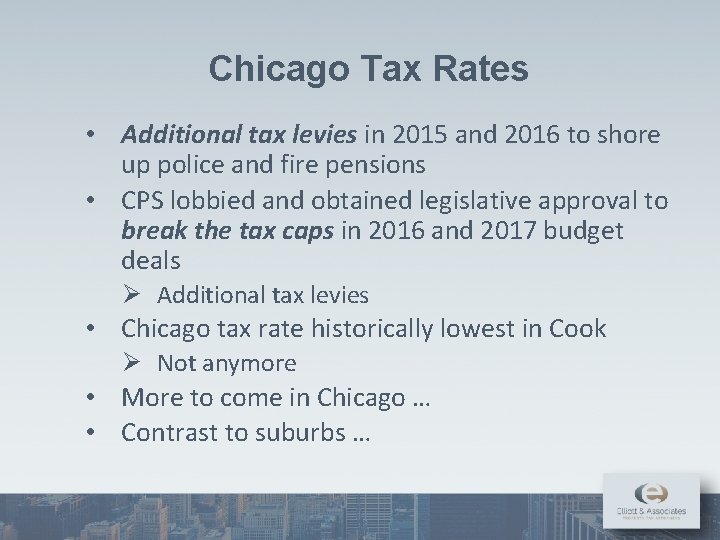

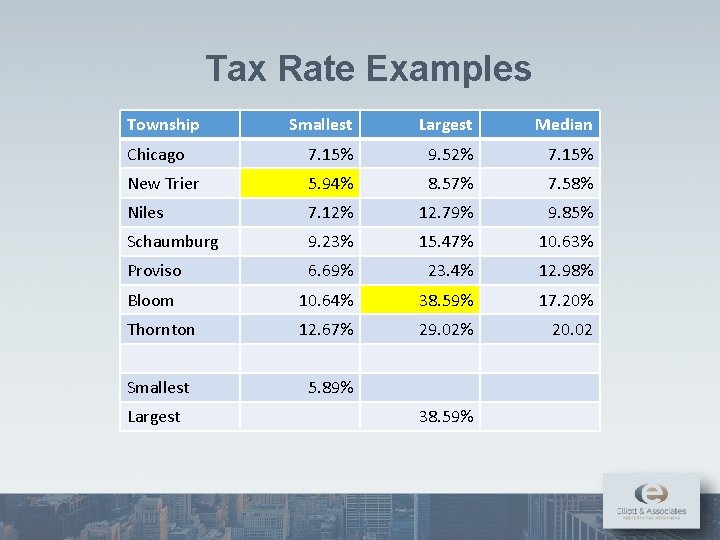

In general all real property in Illinois is taxable and subject to assessment by local assessing authorities. NOT A TRANSFER TAX Inspection required to obtain Certificate of Occupancy Fee 100 ew-ilgov Brookfield Added 7-12-17 Seller No Transfer Tax see comments 8820 Brookfield Ave Brookfield IL 60513 708 485-7344 NOT A TRANSFER TAX Inspection required to obtain Certificate of Compliance httpbrookfieldilg ov. Certain entities are eligible for property tax exemptions under Illinois law such as charitable religious educational and governmental entities. Section 3-33-060 O includes a refund for the CTA portion of tax for transfers to transferees who are age 65 years or older who occupy purchased property as their personal dwelling for at least one year following the transfer if the transfer price is 250000 or less. In general all real property in Illinois is taxable and subject to assessment by local assessing authorities.

Source: pinterest.com

Source: pinterest.com

Unfortunately transfer taxes are not tax deductible. The following transactions are exempt from the transfer tax under 35 ILCS 20031-45. Which property transfers are exempt from real estate transfer tax. The transfer is exempt from the tax except for the money difference or moneys worth paid from one party to the other under 35 ILCS 20031-45 k. A Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date.

Source: pinterest.com

Source: pinterest.com

Which property transfers are exempt from real estate transfer tax. The deed is being filed to divide real estate that is owned in common and no new owners are being added to the deed. The actual consideration amount paid for the property is. A Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date. Section 3-33-060 O includes a refund for the CTA portion of tax for transfers to transferees who are age 65 years or older who occupy purchased property as their personal dwelling for at least one year following the transfer if the transfer price is 250000 or less.

Source: slidetodoc.com

Source: slidetodoc.com

CODES 2 days ago Sales Tax Exemptions in Illinois In Illinois certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. 35 ILCS 20031-45 a. City of Chicago Form 7551 Real Property Transfer Tax Declaration. Some items which are considered to be exempt from sales tax in the state include. In general all real property in Illinois is taxable and subject to assessment by local assessing authorities.

Source: slidetodoc.com

Source: slidetodoc.com

A tax is imposed on the privilege of transferring title to real estate located in Illinois on the privilege of transferring a beneficial interest in real property located in Illinois and on the privilege of transferring a controlling interest in a real estate entity owning property located in Illinois at the rate of 50 for each 500 of value or fraction of 500 stated in the declaration required by Section 31-25. The deed is being filed to divide real estate that is owned in common and no new owners are being added to the deed. The property seller or authorized representative must submit a completed Real Estate Transfer Tax Form marked Declaration or Exemption to the Property Maintenance Division at least 5 BUSINESS DAYS prior to the date of the real estate transferproperty closing or exemption recording via email to transferstampsoaklawn-ilgov. Seller customary Addison 2501000 Village Hall Buyer. A Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date.

Source: civicfed.org

Source: civicfed.org

Thus if one spouse dies without fully utilizing his or her 4 million Illinois. MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the EZDec system. 35 ILCS 20031-45 a. The Illinois estate tax however does not allow for portability. NOT A TRANSFER TAX Inspection required to obtain Certificate of Occupancy Fee 100 ew-ilgov Brookfield Added 7-12-17 Seller No Transfer Tax see comments 8820 Brookfield Ave Brookfield IL 60513 708 485-7344 NOT A TRANSFER TAX Inspection required to obtain Certificate of Compliance httpbrookfieldilg ov.

Source: slidetodoc.com

Source: slidetodoc.com

This exemption is administered through a refund administered by the Tax Division of the Department of Finance located at 333 South State. MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the EZDec system. A tax is imposed on the privilege of transferring title to real estate located in Illinois on the privilege of transferring a beneficial interest in real property located in Illinois and on the privilege of transferring a controlling interest in a real estate entity owning property located in Illinois at the rate of 50 for each 500 of value or fraction of 500 stated in the declaration required by Section 3125. Which property transfers are exempt from real estate transfer tax. MyDec allows you to electronically submit.

Source: pinterest.com

Source: pinterest.com

Can You Deduct Transfer Taxes. The actual consideration amount paid for the property is. NOT A TRANSFER TAX Inspection required to obtain Certificate of Occupancy Fee 100 ew-ilgov Brookfield Added 7-12-17 Seller No Transfer Tax see comments 8820 Brookfield Ave Brookfield IL 60513 708 485-7344 NOT A TRANSFER TAX Inspection required to obtain Certificate of Compliance httpbrookfieldilg ov. State of Illinois Forms PTAX-203 203-A and 203-B. The actual consideration amount paid for the property is less than 100.

Source: templateroller.com

Source: templateroller.com

CODES 2 days ago Sales Tax Exemptions in Illinois In Illinois certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The Illinois state and county exemptions for transfer taxes are as follows. Certain entities are eligible for property tax exemptions under Illinois law such as charitable religious educational and governmental entities. Seller customary All Illinois Counties 25500 County Building Either. The following transactions are exempt from the transfer tax under 35 ILCS 20031-45.

Source: slidetodoc.com

Source: slidetodoc.com

MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the EZDec system. In general all real property in Illinois is taxable and subject to assessment by local assessing authorities. Some items which are considered to be exempt from sales tax in the state include. CODES 2 days ago Sales Tax Exemptions in Illinois In Illinois certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The actual consideration amount paid for the property is less than 100.

Source: listwithclever.com

Source: listwithclever.com

A Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date. Some items which are considered to be exempt from sales tax in the state include. Section 3-33-060 O includes a refund for the CTA portion of tax for transfers to transferees who are age 65 years or older who occupy purchased property as their personal dwelling for at least one year following the transfer if the transfer price is 250000 or less. Certain entities are eligible for property tax exemptions under Illinois law such as charitable religious educational and governmental entities. B Deeds to or trust.

Some items which are considered to be exempt from sales tax in the state include. The Illinois estate tax however does not allow for portability. The form may also be dropped. Which property transfers are exempt from real estate transfer tax. State of Illinois Forms PTAX-203 203-A and 203-B.

Source: pinterest.com

Source: pinterest.com

The federal estate tax exemptions of a married couple can thus be combined so that in 2020 a married couple can effectively transfer up to 2316 million free of federal transfer tax although clients should note that the federal estate tax exemption is slated to be reduced by 50 percent in 2026 and could be reduced earlier by Congress. MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the EZDec system. MyDec allows you to electronically submit. The property seller or authorized representative must submit a completed Real Estate Transfer Tax Form marked Declaration or Exemption to the Property Maintenance Division at least 5 BUSINESS DAYS prior to the date of the real estate transferproperty closing or exemption recording via email to transferstampsoaklawn-ilgov. A tax is imposed on the privilege of transferring title to real estate located in Illinois on the privilege of transferring a beneficial interest in real property located in Illinois and on the privilege of transferring a controlling interest in a real estate entity owning property located in Illinois at the rate of 50 for each 500 of value or fraction of 500 stated in the declaration required by Section 31-25.

Source: pinterest.com

Source: pinterest.com

NOT A TRANSFER TAX Inspection required to obtain Certificate of Occupancy Fee 100 ew-ilgov Brookfield Added 7-12-17 Seller No Transfer Tax see comments 8820 Brookfield Ave Brookfield IL 60513 708 485-7344 NOT A TRANSFER TAX Inspection required to obtain Certificate of Compliance httpbrookfieldilg ov. Seller customary Addison 2501000 Village Hall Buyer. This exemption is administered through a refund administered by the Tax Division of the Department of Finance located at 333 South State. Machinery and building materials for real estate development. The following transactions are exempt from the transfer tax under 35 ILCS 20031-45.

Source: templateroller.com

Source: templateroller.com

The Illinois estate tax however does not allow for portability. Section 3-33-060 O includes a refund for the CTA portion of tax for transfers to transferees who are age 65 years or older who occupy purchased property as their personal dwelling for at least one year following the transfer if the transfer price is 250000 or less. A Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date. In addition counties may apply an additional tax of 025 per 500. A Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date.

Source: deeds.com

Source: deeds.com

In addition counties may apply an additional tax of 025 per 500. MyDec allows you to electronically submit. A Deeds representing real estate transfers made before January 1 1968 but recorded after that date and trust documents executed before January 1 1986 but recorded after that date. A tax is imposed on the privilege of transferring title to real estate located in Illinois on the privilege of transferring a beneficial interest in real property located in Illinois and on the privilege of transferring a controlling interest in a real estate entity owning property located in Illinois at the rate of 50 for each 500 of value or fraction of 500 stated in the declaration required by Section 31-25. Seller customary All Illinois Counties 25500 County Building Either.

Source: slidetodoc.com

Source: slidetodoc.com

Some items which are considered to be exempt from sales tax in the state include. MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the EZDec system. A tax is imposed on the privilege of transferring title to real estate located in Illinois on the privilege of transferring a beneficial interest in real property located in Illinois and on the privilege of transferring a controlling interest in a real estate entity owning property located in Illinois at the rate of 50 for each 500 of value or fraction of 500 stated in the declaration required by Section 31-25. Thus if one spouse dies without fully utilizing his or her 4 million Illinois. State of Illinois Forms PTAX-203 203-A and 203-B.

Source: civicfed.org

Source: civicfed.org

Can You Deduct Transfer Taxes. Seller customary All Illinois Counties 25500 County Building Either. The form may also be dropped. City of Chicago Form 7551 Real Property Transfer Tax Declaration. A tax is imposed on the privilege of transferring title to real estate located in Illinois on the privilege of transferring a beneficial interest in real property located in Illinois and on the privilege of transferring a controlling interest in a real estate entity owning property located in Illinois at the rate of 50 for each 500 of value or fraction of 500 stated in the declaration required by Section 31-25.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title illinois real estate transfer tax exemptions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.