Your Income tax for real estate developers images are available. Income tax for real estate developers are a topic that is being searched for and liked by netizens today. You can Download the Income tax for real estate developers files here. Find and Download all free vectors.

If you’re looking for income tax for real estate developers images information linked to the income tax for real estate developers interest, you have visit the ideal site. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

Income Tax For Real Estate Developers. The difference in these tax rates can be as high as 246. The proceeds from the sale of real properties held primarily for sale to customers in the ordinary course of trade or business or sale of real properties classified as ordinary assets of the seller who is not habitually engaged in real estate business shall be included in the sellers global income. Thus 1 above cannot be avoided. The final regulations for the IRC.

New Insurance Product To The Rescue Of Real Estate Developers Business Line Real Estate Development Development Real Estate From in.pinterest.com

New Insurance Product To The Rescue Of Real Estate Developers Business Line Real Estate Development Development Real Estate From in.pinterest.com

The developer will want to maximize the amount of long-term capital gains taxes paid on the development transaction since long-term capital gains tax rates are significantly lower than ordinary income tax rates. Further the Tax Court noted that on the facts there was no need for Concinnity to construct the water and wastewater systems to promote sales and attracting buyers because the taxpayers owned Development-the. Tax rate The corporate tax rate is 302522 as applicable. Thus 1 above cannot be avoided. Currently long-term capital gains are taxed at preferential rates. At least 10 of the total revenue as per agreements of sale or any legally enforceable documents are realised at reporting date in respect of each of the contracts.

For all LLPs the tax rate will be 30 Minimum Alternate Tax MATAlternate Minimum Tax AMT A company is required to pay MAT on book profits at the rate of 015 as applicable.

The developer will want to maximize the amount of long-term capital gains taxes paid on the development transaction since long-term capital gains tax rates are significantly lower than ordinary income tax rates. With appropriate tax planning and consideration the developer may be able to defer income upon the sale of the land parcels. The developer will want to maximize the amount of long-term capital gains taxes paid on the development transaction since long-term capital gains tax rates are significantly lower than ordinary income tax rates. Tax rate The corporate tax rate is 302522 as applicable. The difference in these tax rates can be as high as 246. The proceeds from the sale of real properties held primarily for sale to customers in the ordinary course of trade or business or sale of real properties classified as ordinary assets of the seller who is not habitually engaged in real estate business shall be included in the sellers global income.

Source: mashvisor.com

Source: mashvisor.com

The maximum rate is 20 compared to the top ordinary income rate of 37. At least 10 of the total revenue as per agreements of sale or any legally enforceable documents are realised at reporting date in respect of each of the contracts. However the taxpayer cannot defer the gain until all of the property is sold but must recognize it as each parcel is disposed of. In a recent press conference conducted by the Honble Finance Minister Ms. Nirmala Sitharaman on 12 th November 2020 followed by a press release dated 13 th November 2020 Diwali gift for the real estate developers and home buyers was announced in the form of income tax relief where a new amendment was proposed in section 43CA and Section 562x of the Income Tax Act 1961 Act.

Source: ar.pinterest.com

Source: ar.pinterest.com

For all LLPs the tax rate will be 30 Minimum Alternate Tax MATAlternate Minimum Tax AMT A company is required to pay MAT on book profits at the rate of 015 as applicable. Further the Tax Court noted that on the facts there was no need for Concinnity to construct the water and wastewater systems to promote sales and attracting buyers because the taxpayers owned Development-the. This forms part of the sellers other income subject to 30 regular income tax. The maximum rate is 20 compared to the top ordinary income rate of 37. When the stage of completion of the project reaches 25 or more where construction of development cost is incurred 25 or more of the total cost apart from cost of land.

Source: in.pinterest.com

Source: in.pinterest.com

Houses 8 days ago Fee income Developer fees management fees and commissions are important income streams and sources of current cash flow for those in the real estate business. There may be an unexpected tax benefit for you. The developer will want to maximize the amount of long-term capital gains taxes paid on the development transaction since long-term capital gains tax rates are significantly lower than ordinary income tax rates. Unfortunately from an income tax perspective these are typically treated as ordinary income with no shelter other than the related operating expenses. If youre in the 24 tax bracket thats how much youll pay on your taxable rental.

Source: in.pinterest.com

Source: in.pinterest.com

The Tax Court reasoned this level of activity was more akin to a real estate developers involvement in a development project than to an investors increasing the value of his holdings. Low-income housing tax credits In order to encourage developers to build manage and maintain affordable rental housing for lower income persons Federal tax law provides a very generous tax credit and some states eg. Given that income is clearly subject to taxation 1 under the Internal Revenue Code 2 generally by referring to Code Section 61 3 there is little likelihood that the developer in the above scenario could avoid paying tax on the income earned in connection with a real estate development. The final regulations for the IRC. Typically developersdealers treat profits and losses from the sale of real property as ordinary income.

Source: taxguru.in

Source: taxguru.in

A third and very significant tax change for developers and investors is the proposed change to capital gain tax rates. In order to clarify the issue as to whether real estate developers shall account income on Project Completion Method or proportionately over the period of the project the ICAI came out with a Guidance Note on Real Estate Developers in 2006. Unfortunately from an income tax perspective these are typically treated as ordinary income with no shelter other than the related operating expenses. When the stage of completion of the project reaches 25 or more where construction of development cost is incurred 25 or more of the total cost apart from cost of land. Section 199 - Domestic Production Activities Deduction may apply to some activities for companies within the real estate industry including construction companies homebuilders and engineering and architectural firms.

Source: in.pinterest.com

Source: in.pinterest.com

The Federal tax credit is generally 9 per year of the eligible cost of the buildings each year for a 10-year period ie. At least 10 of the total revenue as per agreements of sale or any legally enforceable documents are realised at reporting date in respect of each of the contracts. Tax rate The corporate tax rate is 302522 as applicable. Section 199 - Domestic Production Activities Deduction may apply to some activities for companies within the real estate industry including construction companies homebuilders and engineering and architectural firms. Currently long-term capital gains are taxed at preferential rates.

Source: pinterest.com

Source: pinterest.com

The proceeds from the sale of real properties held primarily for sale to customers in the ordinary course of trade or business or sale of real properties classified as ordinary assets of the seller who is not habitually engaged in real estate business shall be included in the sellers global income. The developer will want to maximize the amount of long-term capital gains taxes paid on the development transaction since long-term capital gains tax rates are significantly lower than ordinary income tax rates. Further the Tax Court noted that on the facts there was no need for Concinnity to construct the water and wastewater systems to promote sales and attracting buyers because the taxpayers owned Development-the. The Federal tax credit is generally 9 per year of the eligible cost of the buildings each year for a 10-year period ie. The difference in these tax rates can be as high as 246.

Source: in.pinterest.com

Source: in.pinterest.com

There may be an unexpected tax benefit for you. The short answer is that rental income is taxed as ordinary income. This 246 difference means the difference between netting 792500 after-tax on a 1000000 sale as opposed to only. In a recent press conference conducted by the Honble Finance Minister Ms. The final regulations for the IRC.

Source: pinterest.com

Source: pinterest.com

Without regard to the production period a real estate developer must under Code Section 263A capitalize real estate taxes even if no development takes place. This 246 difference means the difference between netting 792500 after-tax on a 1000000 sale as opposed to only. Low-income housing tax credits In order to encourage developers to build manage and maintain affordable rental housing for lower income persons Federal tax law provides a very generous tax credit and some states eg. Unfortunately from an income tax perspective these are typically treated as ordinary income with no shelter other than the related operating expenses. The Tax Court reasoned this level of activity was more akin to a real estate developers involvement in a development project than to an investors increasing the value of his holdings.

Source: pinterest.com

Source: pinterest.com

Further the Tax Court noted that on the facts there was no need for Concinnity to construct the water and wastewater systems to promote sales and attracting buyers because the taxpayers owned Development-the. A third and very significant tax change for developers and investors is the proposed change to capital gain tax rates. In order to clarify the issue as to whether real estate developers shall account income on Project Completion Method or proportionately over the period of the project the ICAI came out with a Guidance Note on Real Estate Developers in 2006. This forms part of the sellers other income subject to 30 regular income tax. The Tax Court reasoned this level of activity was more akin to a real estate developers involvement in a development project than to an investors increasing the value of his holdings.

Source: pinterest.com

Source: pinterest.com

For all LLPs the tax rate will be 30 Minimum Alternate Tax MATAlternate Minimum Tax AMT A company is required to pay MAT on book profits at the rate of 015 as applicable. Further the Tax Court noted that on the facts there was no need for Concinnity to construct the water and wastewater systems to promote sales and attracting buyers because the taxpayers owned Development-the. The short answer is that rental income is taxed as ordinary income. However the taxpayer cannot defer the gain until all of the property is sold but must recognize it as each parcel is disposed of. Currently long-term capital gains are taxed at preferential rates.

Source: br.pinterest.com

Source: br.pinterest.com

Georgia provide a similar or matching credit. Section 199 - Domestic Production Activities Deduction may apply to some activities for companies within the real estate industry including construction companies homebuilders and engineering and architectural firms. The developer will want to maximize the amount of long-term capital gains taxes paid on the development transaction since long-term capital gains tax rates are significantly lower than ordinary income tax rates. A taxpayer should be cautious in choosing a method without tax planning as this may be considered an accounting method and only can be changed by. Depending on the taxpayers income and filing status ordinary income may be taxed at the 396 percent rate or.

Source: in.pinterest.com

Source: in.pinterest.com

It is a little-known fact that real estate developers can reap more favorable tax treatment of property sales depending on how they classify and distinguish these activities. The maximum rate is 20 compared to the top ordinary income rate of 37. For all LLPs the tax rate will be 30 Minimum Alternate Tax MATAlternate Minimum Tax AMT A company is required to pay MAT on book profits at the rate of 015 as applicable. Houses 8 days ago Fee income Developer fees management fees and commissions are important income streams and sources of current cash flow for those in the real estate business. Thus 1 above cannot be avoided.

Source: de.pinterest.com

Source: de.pinterest.com

With appropriate tax planning and consideration the developer may be able to defer income upon the sale of the land parcels. Thus 1 above cannot be avoided. When the stage of completion of the project reaches 25 or more where construction of development cost is incurred 25 or more of the total cost apart from cost of land. Currently long-term capital gains are taxed at preferential rates. It is a little-known fact that real estate developers can reap more favorable tax treatment of property sales depending on how they classify and distinguish these activities.

Source: in.pinterest.com

Source: in.pinterest.com

The proceeds from the sale of real properties held primarily for sale to customers in the ordinary course of trade or business or sale of real properties classified as ordinary assets of the seller who is not habitually engaged in real estate business shall be included in the sellers global income. The short answer is that rental income is taxed as ordinary income. The Federal tax credit is generally 9 per year of the eligible cost of the buildings each year for a 10-year period ie. The developer will want to maximize the amount of long-term capital gains taxes paid on the development transaction since long-term capital gains tax rates are significantly lower than ordinary income tax rates. The Tax Court reasoned this level of activity was more akin to a real estate developers involvement in a development project than to an investors increasing the value of his holdings.

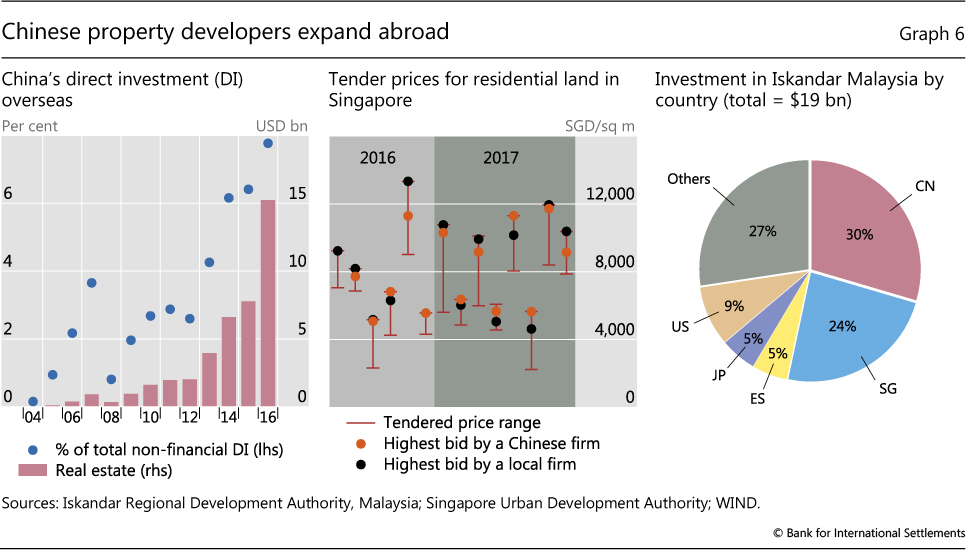

Source: bis.org

Source: bis.org

There may be an unexpected tax benefit for you. Without regard to the production period a real estate developer must under Code Section 263A capitalize real estate taxes even if no development takes place. Further the Tax Court noted that on the facts there was no need for Concinnity to construct the water and wastewater systems to promote sales and attracting buyers because the taxpayers owned Development-the. In order to clarify the issue as to whether real estate developers shall account income on Project Completion Method or proportionately over the period of the project the ICAI came out with a Guidance Note on Real Estate Developers in 2006. Currently long-term capital gains are taxed at preferential rates.

Source: pinterest.com

Source: pinterest.com

Currently long-term capital gains are taxed at preferential rates. Section 199 - Domestic Production Activities Deduction may apply to some activities for companies within the real estate industry including construction companies homebuilders and engineering and architectural firms. Further the Tax Court noted that on the facts there was no need for Concinnity to construct the water and wastewater systems to promote sales and attracting buyers because the taxpayers owned Development-the. Given that income is clearly subject to taxation 1 under the Internal Revenue Code 2 generally by referring to Code Section 61 3 there is little likelihood that the developer in the above scenario could avoid paying tax on the income earned in connection with a real estate development. Typically developersdealers treat profits and losses from the sale of real property as ordinary income.

Source: br.pinterest.com

Source: br.pinterest.com

The Federal tax credit is generally 9 per year of the eligible cost of the buildings each year for a 10-year period ie. Para 3 to 5 of the Guidance Note has clarified the point of time when significant risks and. This 246 difference means the difference between netting 792500 after-tax on a 1000000 sale as opposed to only. The Tax Court reasoned this level of activity was more akin to a real estate developers involvement in a development project than to an investors increasing the value of his holdings. Georgia provide a similar or matching credit.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title income tax for real estate developers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.