Your Kane county real estate taxes 2018 images are available. Kane county real estate taxes 2018 are a topic that is being searched for and liked by netizens today. You can Find and Download the Kane county real estate taxes 2018 files here. Get all free photos and vectors.

If you’re looking for kane county real estate taxes 2018 images information related to the kane county real estate taxes 2018 interest, you have visit the ideal blog. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

Kane County Real Estate Taxes 2018. Kane County Government Center 719 S. The second installment just as an FYI is due Sept. Kane County Property Tax Inquiry. Kane County Treasurer 719 S.

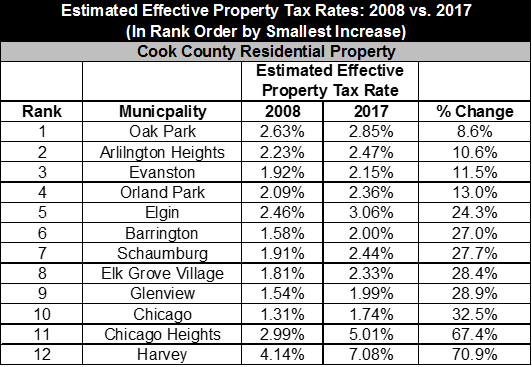

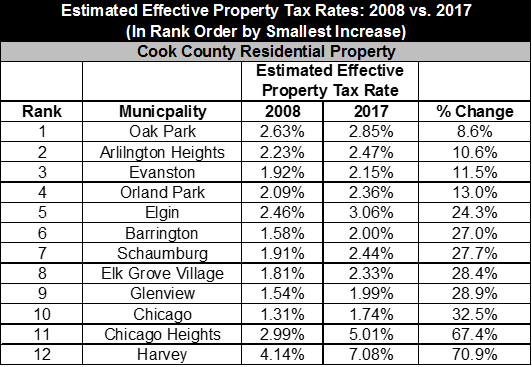

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation From civicfed.org

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation From civicfed.org

Not everone is as lucky as you are clue Brooks Edge Ln Fishers IN realtor hamilton county indiana real estate tax bill 516 1st Ave Se Carmel IN realtor County Road 36 Goshen IN realtor 1409 Cottonwood Cir Noblesville IN realtor brown county is a county. Payments online full amount due for 2020 and previous years. Everything you should know about your Kane County Tax Bill. When it comes to issues with local real estate one of the hardest things for people to understand is the property tax billing process. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. Enter Parcel Number with or without dashes Parcel Number.

Enter Parcel Number with or without dashes Parcel Number.

Hamilton County Indiana Real Estate Tax Bill. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. The Kane County Recorders Office is pleased to announce our latest technology which electronically processes Property Transactions PTAX-203 forms through MyDec. The 49940 filers in Kane County who still owed the IRS paid an average of 4962 for 2018. Everything you should know about your Kane County Tax Bill. Yearly median tax in Kane County.

Source: realtor.com

Source: realtor.com

See what the tax bill is for any Kane County IL property by simply typing its address into a search bar. 630-208-7549 Office Hours Monday Thru Friday 830 am to 430 pm Email Us. Kane County collects on average 209 of a propertys assessed fair market value as property tax. Batavia Avenue Geneva IL. When it comes to issues with local real estate one of the hardest things for people to understand is the property tax billing process.

Source: propertyshark.com

Source: propertyshark.com

Bldg A Geneva IL 60134 Phone. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. Illinois In Illinois 4602450 filers got an average refund of 2944. Kane County Government Center 719 S. Kane County Clerk Jack Cunningham reports that Net Taxable Valuation for Kane County is 13844989451 thats 13 billion with a b with a total real estate tax extension of 1299306673.

Source: metroeastsun.com

Source: metroeastsun.com

11 рядків For the 2018 taxes payable in 2019 the rate is 007 per 10000 of EAV. Kane County Government Center 719 S. Upon receipt of the collector books from the County Clerk the County Collector prepares tax bills for real estate taxes within the County and mails them to. County Clerk Jack Cunningham reports that Net Taxable Valuation for Kane County is 13844989451 with a total real estate tax extension of 1299306673. Kane County Treasurer 719 S.

County Clerk Jack Cunningham reports that Net Taxable Valuation for Kane County is 13844989451 with a total real estate tax extension of 1299306673. See Kane County IL tax rates tax exemptions for any property the tax assessment history for the past years and more. 630-208-7549 Office Hours Monday Thru Friday 830 am to 430 pm Email Us. Monday through Friday except on holidays. Illinois In Illinois 4602450 filers got an average refund of 2944.

Source: realtor.com

Source: realtor.com

HOW TO PAY TAXES. Yearly median tax in Kane County. Bldg A Geneva IL 60134 Phone. County Clerk Jack Cunningham reports that Net Taxable Valuation for Kane County is 13844989451 with a total real estate tax extension of 1299306673. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill.

See Kane County IL tax rates tax exemptions for any property the tax assessment history for the past years and more. Enter your search criteria into at least one of the following fields. Pre-Payments and previous years cash check or money order mail payment to 76 North Main Kanab UT 84741 Credit CardE-Check for ALL tax payments. Batavia Ave Bldg A Geneva IL 60134 630-232-3400. Property taxes are paid at the Kane County Treasurers office located at 719 S.

Source: civicfed.org

Source: civicfed.org

Call Treasurers Office 435 644-5659. Enter your search criteria into at least one of the following fields. 630-208-7549 Office Hours Monday Thru Friday 830 am to 430 pm Email Us. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. Payments online full amount due for 2020 and previous years.

05222018 Adjusted Print DPI default from 300 dpi to 96 dpi 05152018 Added check for LatLng Values before launching BirdsEye 05152018 Replaced PinInfo ClearGraphics and DevLog buttons with images 05022018 KaneGIS4 went live replacing the original KaneGIS2014x application 04302018 Upgraded to ArcGIS API for JavaScript 47 release. When it comes to issues with local real estate one of the hardest things for people to understand is the property tax billing process. MyDec is a new electronic system that handles Real Property Transfer Tax transactions through the Illinois Department of Revenue. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. 630-208-7549 Office Hours Monday Thru Friday 830 am to 430 pm Email Us.

Source: pinterest.com

Source: pinterest.com

The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill. 11 рядків For the 2018 taxes payable in 2019 the rate is 007 per 10000 of EAV. Kane County Property Tax Inquiry. 05222018 Adjusted Print DPI default from 300 dpi to 96 dpi 05152018 Added check for LatLng Values before launching BirdsEye 05152018 Replaced PinInfo ClearGraphics and DevLog buttons with images 05022018 KaneGIS4 went live replacing the original KaneGIS2014x application 04302018 Upgraded to ArcGIS API for JavaScript 47 release. When it comes to issues with local real estate one of the hardest things for people to understand is the property tax billing process.

The County Collector is charged by the County Clerk to collect all of the taxes levied by approximately 270 local taxing bodies within Kane County. See Kane County IL tax rates tax exemptions for any property the tax assessment history for the past years and more. Enter Parcel Number with or without dashes Parcel Number. MyDec is a new electronic system that handles Real Property Transfer Tax transactions through the Illinois Department of Revenue. Yearly median tax in Kane County.

Source: realtor.com

Source: realtor.com

Upon receipt of the collector books from the County Clerk the County Collector prepares tax bills for real estate taxes within the County and mails them to. In Illinois our property tax bills are billed in arrears. Bldg A Geneva IL 60134 Phone. See what the tax bill is for any Kane County IL property by simply typing its address into a search bar. Everything you should know about your Kane County Tax Bill.

Kane County Government Center 719 S. Kane County collects on average 209 of a propertys assessed fair market value as property tax. Kane County Treasurer 719 S. Property taxes are paid at the Kane County Treasurers office located at 719 S. Kane County Government Center 719 S.

Source: pinterest.com

Source: pinterest.com

Upon receipt of the collector books from the County Clerk the County Collector prepares tax bills for real estate taxes within the County and mails them to. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. Not everone is as lucky as you are clue Brooks Edge Ln Fishers IN realtor hamilton county indiana real estate tax bill 516 1st Ave Se Carmel IN realtor County Road 36 Goshen IN realtor 1409 Cottonwood Cir Noblesville IN realtor brown county is a county. The second installment just as an FYI is due Sept. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill.

Source: pinterest.com

Source: pinterest.com

The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. Hamilton County Indiana Real Estate Tax Bill. Kane County collects on average 209 of a propertys assessed fair market value as property tax. 209 of home value. Pre-Payments and previous years cash check or money order mail payment to 76 North Main Kanab UT 84741 Credit CardE-Check for ALL tax payments.

Source: metroeastsun.com

Source: metroeastsun.com

209 of home value. Our Kane County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Illinois and across the entire United States. Kane county oppose the illinois general assembly instituting a 1 annual real estate tax vote for 1 votes of votes. In Illinois our property tax bills are billed in arrears. Illinois In Illinois 4602450 filers got an average refund of 2944.

Source: pinterest.com

Source: pinterest.com

Payments online full amount due for 2020 and previous years. Enter Parcel Number with or without dashes Parcel Number. 05222018 Adjusted Print DPI default from 300 dpi to 96 dpi 05152018 Added check for LatLng Values before launching BirdsEye 05152018 Replaced PinInfo ClearGraphics and DevLog buttons with images 05022018 KaneGIS4 went live replacing the original KaneGIS2014x application 04302018 Upgraded to ArcGIS API for JavaScript 47 release. The second installment just as an FYI is due Sept. The County Collector is charged by the County Clerk to collect all of the taxes levied by approximately 270 local taxing bodies within Kane County.

Source: realtor.com

Source: realtor.com

Bldg A Geneva IL 60134 Phone. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill. MyDec is a new electronic system that handles Real Property Transfer Tax transactions through the Illinois Department of Revenue. Kane county oppose the illinois general assembly instituting a 1 annual real estate tax vote for 1 votes of votes. Bldg A Geneva IL 60134 Phone.

Source: realtor.com

Source: realtor.com

Kane County Property Tax Inquiry. See what the tax bill is for any Kane County IL property by simply typing its address into a search bar. The second installment just as an FYI is due Sept. Pre-Payments and previous years cash check or money order mail payment to 76 North Main Kanab UT 84741 Credit CardE-Check for ALL tax payments. In Illinois our property tax bills are billed in arrears.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title kane county real estate taxes 2018 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.