Your Lackawanna county real estate tax bill images are ready. Lackawanna county real estate tax bill are a topic that is being searched for and liked by netizens today. You can Download the Lackawanna county real estate tax bill files here. Find and Download all royalty-free images.

If you’re looking for lackawanna county real estate tax bill images information linked to the lackawanna county real estate tax bill topic, you have pay a visit to the right blog. Our site frequently provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Lackawanna County Real Estate Tax Bill. They are maintained by various government offices in Lackawanna County Pennsylvania State and at the Federal level. SCRANTON Lackawanna County commissioners introduced a tentative 2021 budget Thursday that does not hike property taxes next year. A 10 penalty on a tax bill can be significant especially for people whose assessed property value is relatively high. Lackawanna County Assessors Office Search Link.

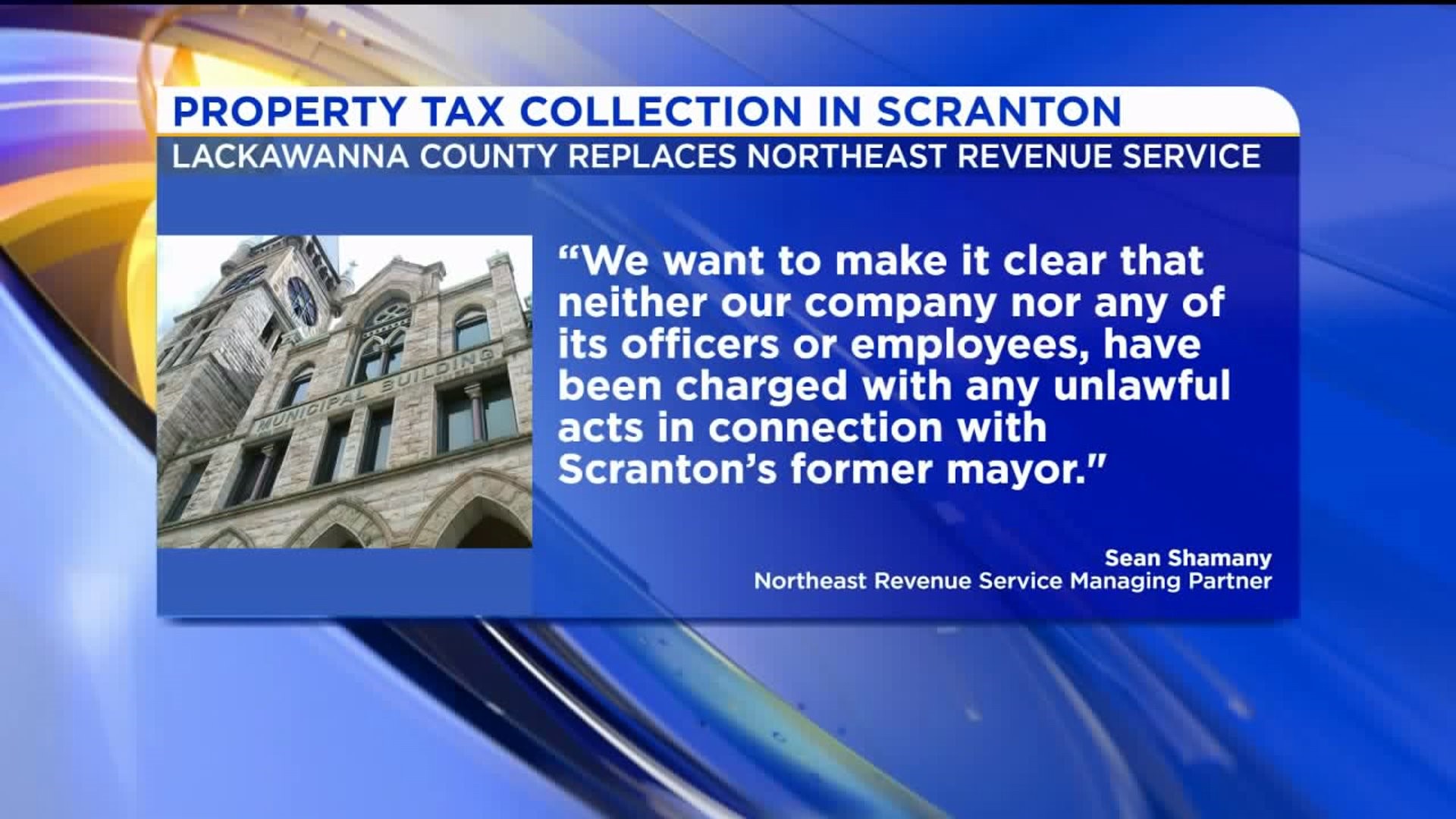

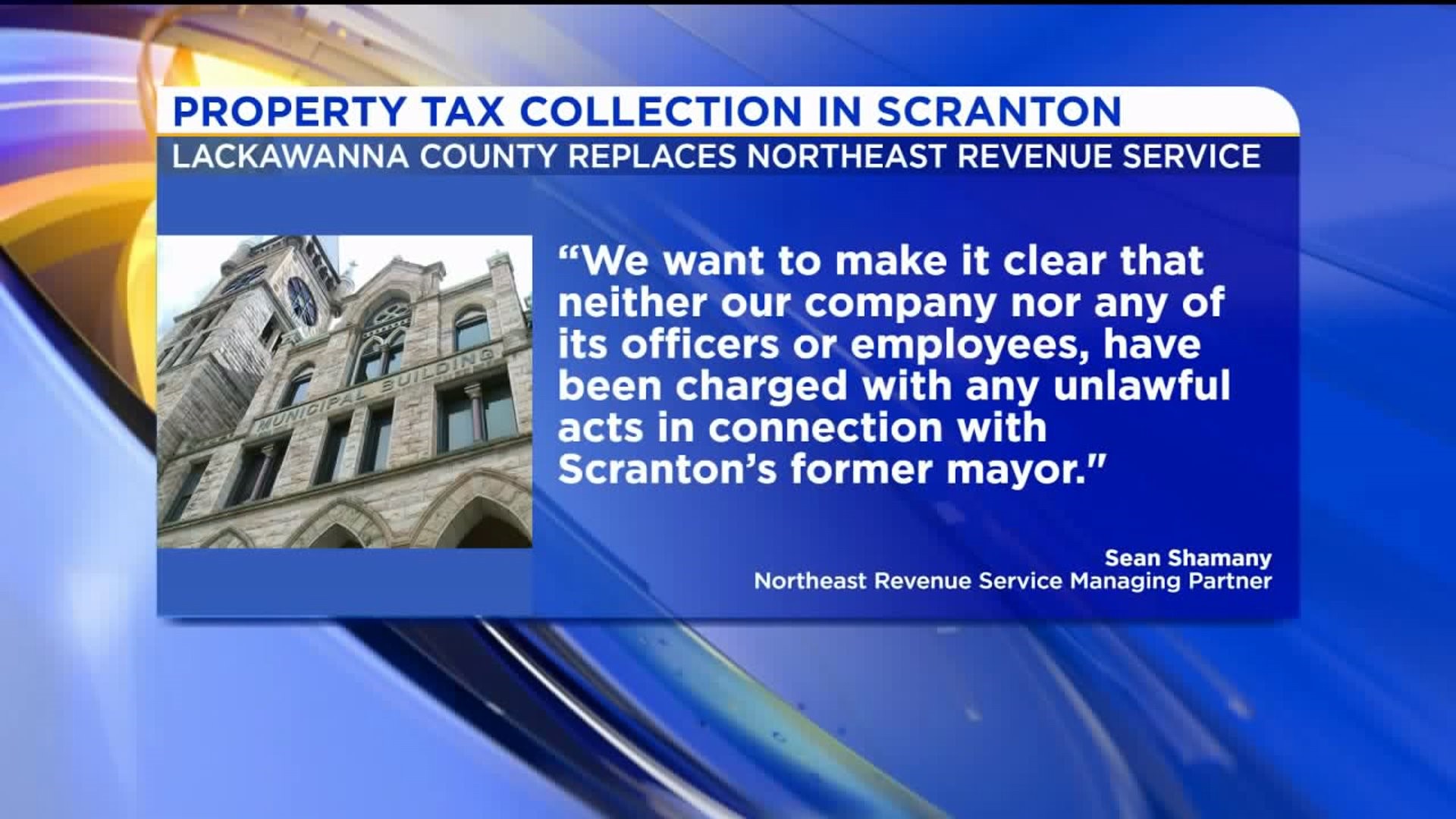

Lackawanna County To Start Collecting Scranton S Property Taxes Wnep Com From wnep.com

Lackawanna County To Start Collecting Scranton S Property Taxes Wnep Com From wnep.com

What will I need to pay my Individual Wage Taxes. Certain types of Tax Records are available to the general public while some Tax. 19509 total views 17 views today. Tax bills are sent out from the County in February and are paid to Lackawanna County. 1376201 1878652. 8662119466 Contact Us Property Owner Resources.

Monday Friday 900 430.

The 1382 million draft 2021 general fund budget. 4 days ago lackawanna county real estate taxes Current millage rate is 5742. 1376201 1878652. Tax bills are sent out from the County in February and are paid to Lackawanna County. Assessors Office Michael Grifa 714 Ridge Road Room 213 Lackawanna New York 14218 Phone. The median property tax in Lackawanna County Pennsylvania is 1954 per year for a home worth the median value of 137100.

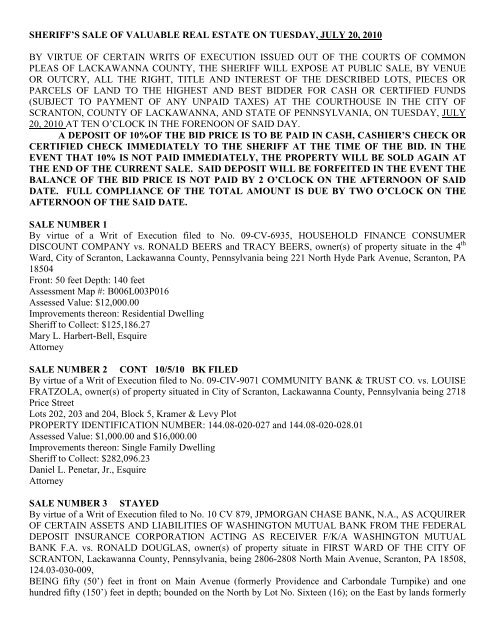

Source: yumpu.com

Source: yumpu.com

Lackawanna county pa property search lackawanna county pa property tax. City Treasurer CITY HALL CLOSED FEBRUARY 12th 15th IN OBSERVANCE OF FEDERAL HOLIDAYS - ERIE COUNTY TAX PAYMENT DEADLINE IS FEBRUARY 16th Lackawanna City Hall will be closed on February 12th and 15th in observance of federal holidays. 19509 total views 17 views today. What will I need to pay my Real Estate Taxes. Assessors Office Michael Grifa 714 Ridge Road Room 213 Lackawanna New York 14218 Phone.

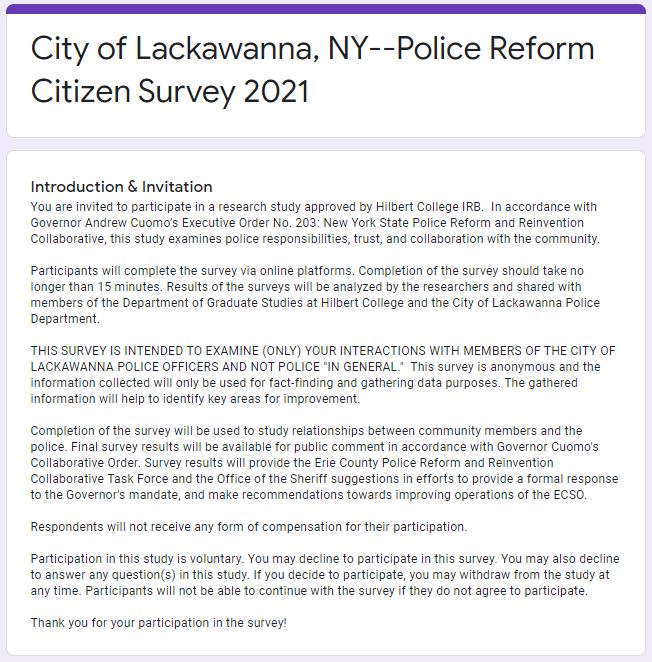

Source: lackawannany.gov

Source: lackawannany.gov

You can pay current year real estate taxes for Lackawanna County Scranton School District and City of Scranton and Refuse to the Single Tax Office. 19509 total views 17 views today. Real estate Show Real Estate. In-depth Lackawanna County PA Property Tax InformationIn order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Due to the 15th being a holiday the deadline for Erie County tax.

Source: wnep.com

Source: wnep.com

Real estate Show Real Estate. 601000 820425. Lackawanna County collects on average 143 of a propertys assessed fair market value as property tax. Lackawanna County has one of the highest median property taxes in the United States and is ranked 477th of the 3143. Monday Friday 900 430.

Source: pdffiller.com

Source: pdffiller.com

However the tax-exempt properties total assessed value the dollar amount used to calculate property tax bills increased about 8½ percent from 305532658 in 2014 to 334039235 in 2018. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Real estate Show Real Estate. Hotel Property Tax Office of Assessment and Appeals Tax Claim Bureau. This information is found on your current year real estate tax bill.

Source: movoto.com

Source: movoto.com

In-depth Lackawanna County PA Property Tax InformationIn order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Lackawanna County collects on average 143 of a propertys assessed fair market value as property tax. Payment options are listed on your tax bill. Real Estate Tax Lackawanna County Scranton Single Tax Office. Lackawanna County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lackawanna County Pennsylvania.

Source: lackawannacounty.org

Source: lackawannacounty.org

However the tax-exempt properties total assessed value the dollar amount used to calculate property tax bills increased about 8½ percent from 305532658 in 2014 to 334039235 in 2018. Records provided in July by Lackawanna County show about 4 percent or 3939 of the countys approximately 101500 properties are exempt from paying real estate taxes. A 10 penalty on a tax bill can be significant especially for people whose assessed property value is relatively high. You can pay current year real estate taxes for Lackawanna County Scranton School District and City of Scranton and Refuse to the Single Tax Office. 601000 820425.

Source: pinterest.com

Source: pinterest.com

Tax bills are sent out from the County in February and are paid to Lackawanna County. A 10 penalty on a tax bill can be significant especially for people whose assessed property value is relatively high. The 1382 million draft 2021 general fund budget. The median property tax in Lackawanna County Pennsylvania is 1954 per year for a home worth the median value of 137100. Lackawanna County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lackawanna County Pennsylvania.

Source: lackawannacounty.org

Source: lackawannacounty.org

28200 38496. Payment options for property owners wishing to make electronic payment of their claims in Lackawanna County. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. 19509 total views 17 views today. A 10 penalty on a tax bill can be significant especially for people whose assessed property value is relatively high.

Source: lackawannany.gov

Source: lackawannany.gov

Hotel Property Tax Office of Assessment and Appeals Tax Claim Bureau. Monday Friday 900 430 Marcia Cullens 714 Ridge Road Room 213 Lackawanna New York 14218 Phone. Hotel Property Tax Office of Assessment and Appeals Tax Claim Bureau. The median property tax in Lackawanna County Pennsylvania is 1954 per year for a home worth the median value of 137100. The county had last raised property taxes in 2013.

Records provided in July by Lackawanna County show about 4 percent or 3939 of the countys approximately 101500 properties are exempt from paying real estate taxes. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. These records can include Lackawanna County property tax assessments and assessment challenges appraisals and income taxes. Lackawanna County Property Records are real estate documents that contain information related to real property in Lackawanna County Pennsylvania. You will need your PIN and amount due.

Source: realtor.com

Source: realtor.com

19509 total views 17 views today. 1376201 1878652. However the tax-exempt properties total assessed value the dollar amount used to calculate property tax bills increased about 8½ percent from 305532658 in 2014 to 334039235 in 2018. 813142 total views 78 views today. Lackawanna County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lackawanna County Pennsylvania.

Source: realtor.com

Source: realtor.com

Lackawanna county pa property search lackawanna county pa property tax. 4 days ago lackawanna county real estate taxes Current millage rate is 5742. A 10 penalty on a tax bill can be significant especially for people whose assessed property value is relatively high. The median property tax in Lackawanna County Pennsylvania is 1954 per year for a home worth the median value of 137100. Certain types of Tax Records are available to the general public while some Tax.

Source: thetimes-tribune.com

Source: thetimes-tribune.com

SCRANTON Lackawanna County commissioners introduced a tentative 2021 budget Thursday that does not hike property taxes next year. Hotel Property Tax Office of Assessment and Appeals Tax Claim Bureau. 4 days ago lackawanna county real estate taxes Current millage rate is 5742. Monday Friday 900 430 Marcia Cullens 714 Ridge Road Room 213 Lackawanna New York 14218 Phone. Assessors Office Michael Grifa 714 Ridge Road Room 213 Lackawanna New York 14218 Phone.

Source: hinerfeldcommercial.com

Source: hinerfeldcommercial.com

Due to the 15th being a holiday the deadline for Erie County tax. However the tax-exempt properties total assessed value the dollar amount used to calculate property tax bills increased about 8½ percent from 305532658 in 2014 to 334039235 in 2018. They are maintained by various government offices in Lackawanna County Pennsylvania State and at the Federal level. The county had last raised property taxes in 2013. They are a valuable tool for the real estate.

Lackawanna County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lackawanna County Pennsylvania. The county had last raised property taxes in 2013. Assessors Office Michael Grifa 714 Ridge Road Room 213 Lackawanna New York 14218 Phone. Real estate Show Real Estate. 1376201 1878652.

Source: mjpeterson.com

Source: mjpeterson.com

Tax Burden for Lackawanna County Residents 2019 A city homeowner earning 24311 annually the median earnings in Scranton spends about 13765 of every 1000 in wages on municipal school and county real estate taxes and local wage taxes. Real estate Show Real Estate. These records can include Lackawanna County property tax assessments and assessment challenges appraisals and income taxes. Payment options are listed on your tax bill. What will I need to pay my Individual Wage Taxes.

Source: lackawannacounty.org

Source: lackawannacounty.org

City Treasurer CITY HALL CLOSED FEBRUARY 12th 15th IN OBSERVANCE OF FEDERAL HOLIDAYS - ERIE COUNTY TAX PAYMENT DEADLINE IS FEBRUARY 16th Lackawanna City Hall will be closed on February 12th and 15th in observance of federal holidays. Lackawanna County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lackawanna County Pennsylvania. 10000 13651. You will need your PIN and amount due. You can pay current year real estate taxes for Lackawanna County Scranton School District and City of Scranton and Refuse to the Single Tax Office.

Source: blog.findnflip.com

Source: blog.findnflip.com

You must know your. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. A 10 penalty on a tax bill can be significant especially for people whose assessed property value is relatively high. What will I need to pay my Individual Wage Taxes. Payment options are listed on your tax bill.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title lackawanna county real estate tax bill by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.